Mosey x Stripe Atlas

Multi-state compliance. Solved.

Mosey and Stripe Atlas have teamed up so founders can operate in any state in a few clicks.

Multi-state compliance for growing startups

Avoid days of sifting through confusing government websites and spending thousands of dollars in legal fees. Use Mosey to register locally, open tax accounts, and stay compliant in all 50 states and thousands of localities.

Compliance for growing startups

Mosey enables your team to focus on building the business instead of becoming a compliance expert.

Manage HR, payroll, tax, and entity compliance all in one platform, making it easy to stay compliant as you grow.

Automate opening tax accounts and registering with the Secretary of State so you can hire in new states quickly.

Eliminate the manual guess-work and get notified if there are compliance issues or new requirements.

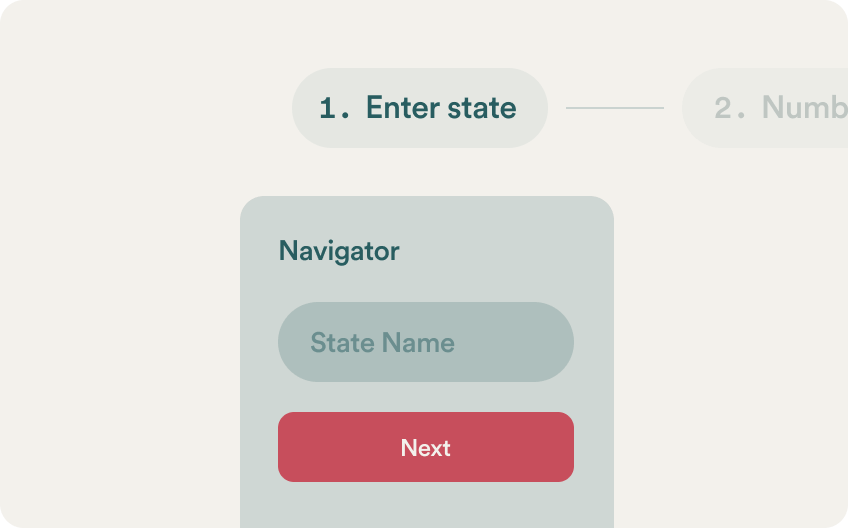

Get started fast

Sign up for Mosey, configure your account, and get compliant everywhere.

01

Sign up

Create your account and fill in your business profile. Don’t worry, we’ll only need to ask you once.

02

Configure your account

Import your existing location to tell Mosey what to monitor.

03

Identify and resolve

Use Mosey to identify compliance gaps, take action, and automatically resolve them.

All the information you require

Mosey covers all 50 states, DC, and 1,000+ cities and counties.

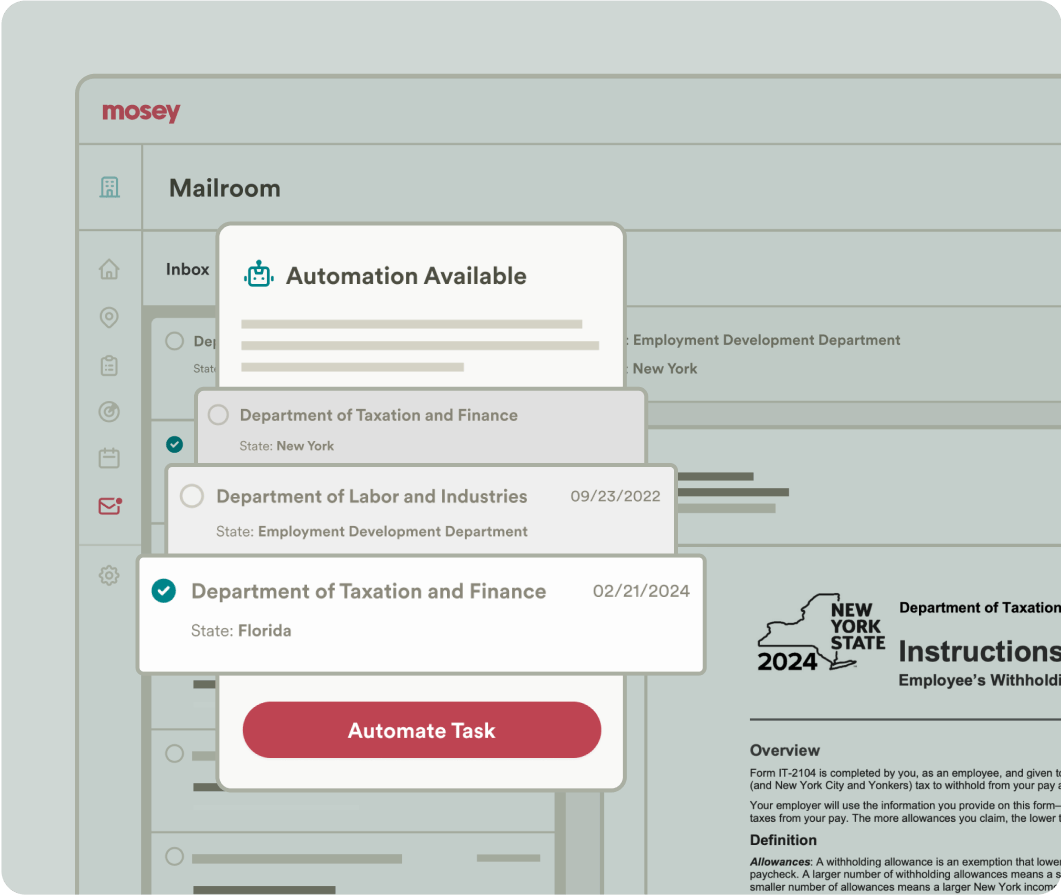

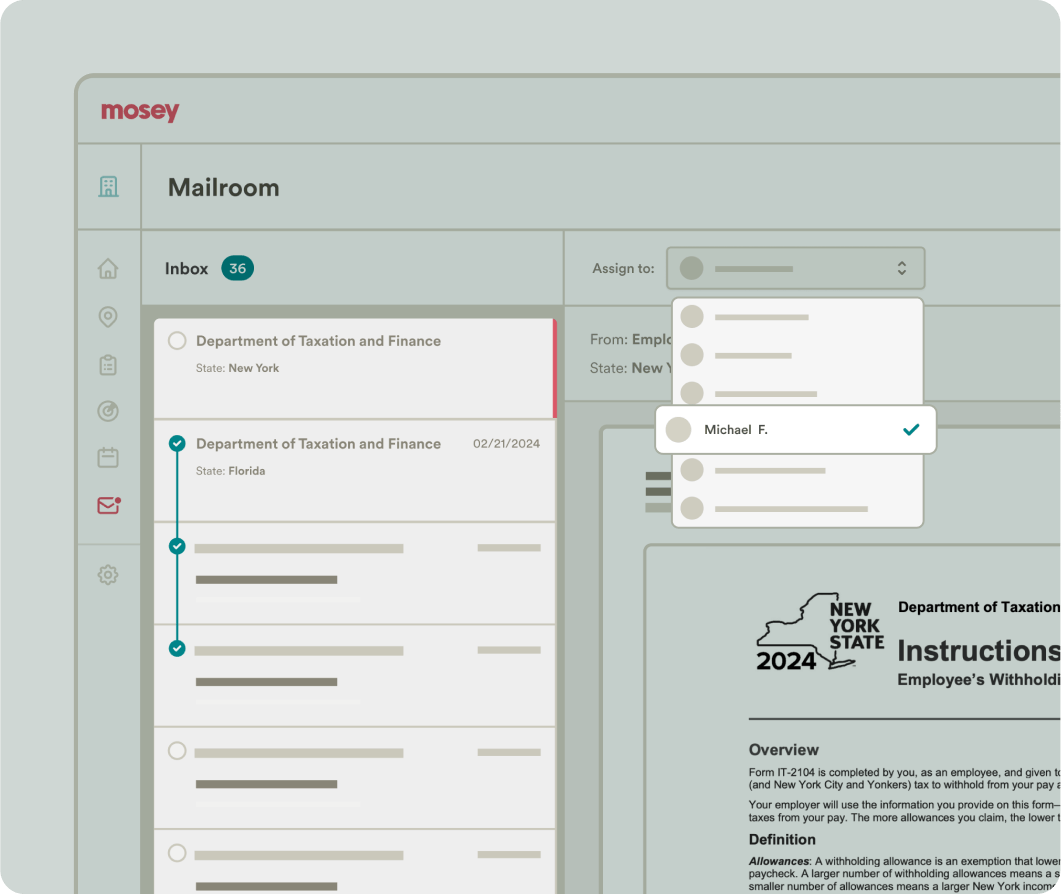

Instead of receiving snail mail at your home or business location, you can receive mail virtually in your Mosey app. If you already have state accounts open, you can update those to start receiving your state mail in Mosey. When Mosey automates new accounts for you, we'll list your Mosey mailroom address. Additionally, you can make Mosey your Registered Agent for both existing registrations with the Secretary of State, or when automating foreign qualification in Mosey. You'll receive a notification whenever a new piece of mail is scanned and delivered to your mailroom. All mail can be downloaded as a PDF, or assigned to a member of your team. Most importantly, it is all kept securely in one spot so you'll never miss a notice.

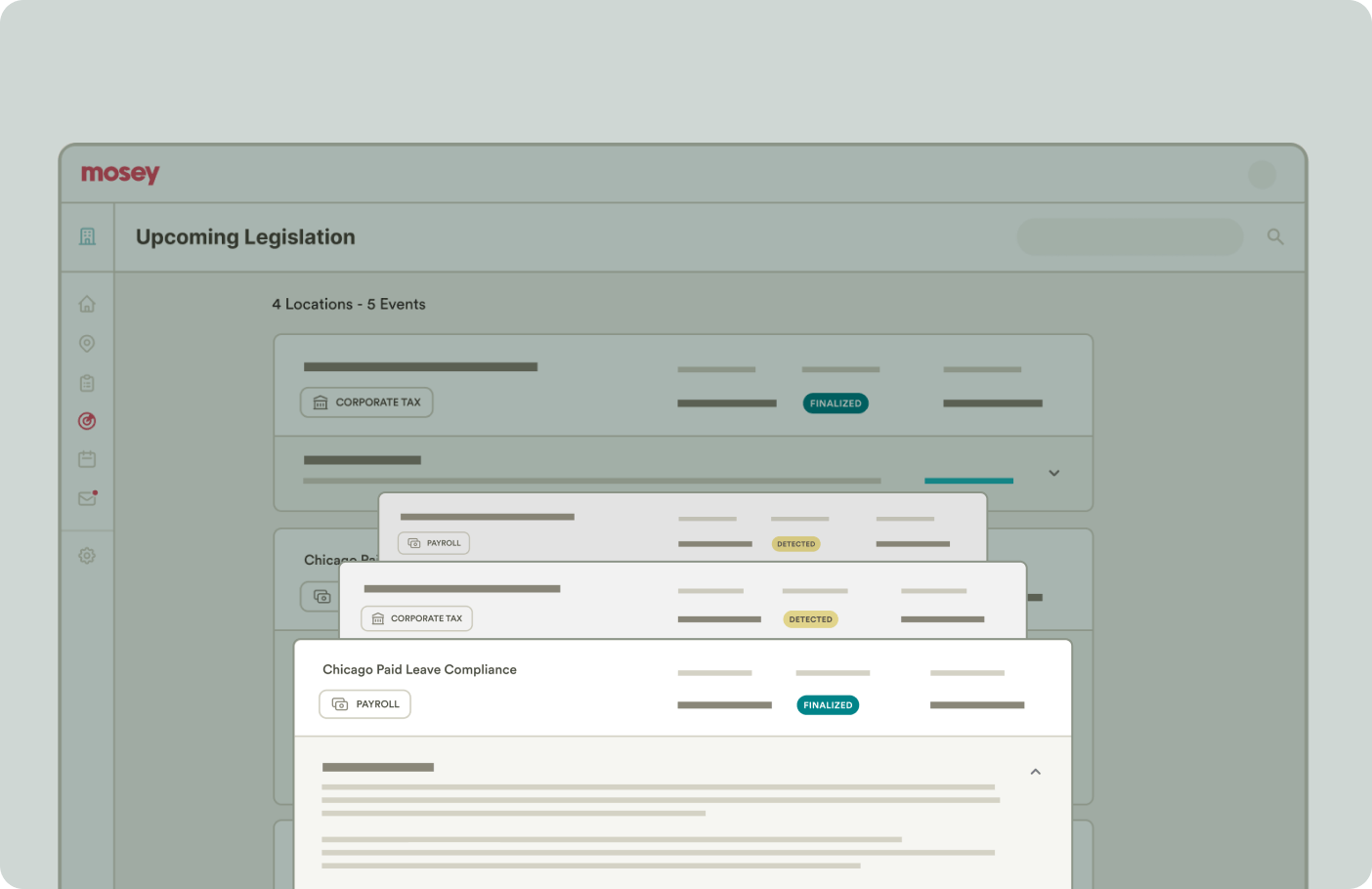

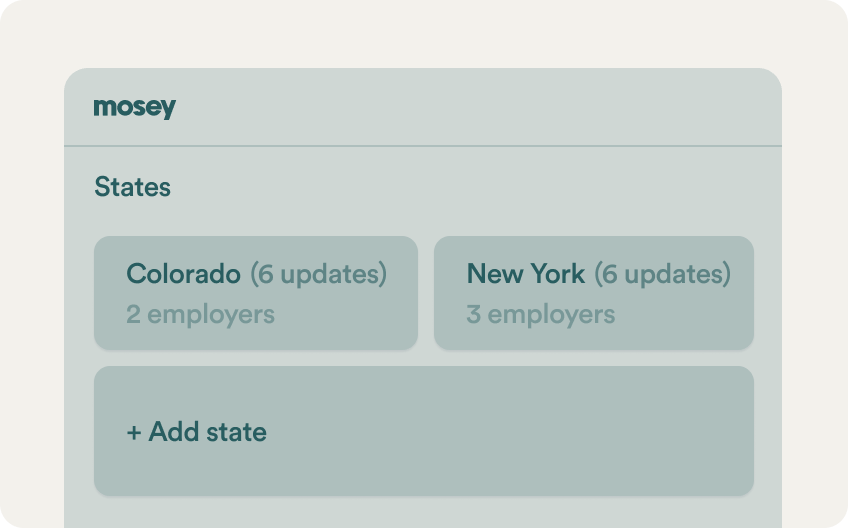

You can import information for states you’ve already registered in, and Mosey will monitor new and recurring requirements for your business in those locations — and add more as you grow. But compliance is ongoing. As your business changes, you will hit new thresholds for state and local requirements (i.e., once you have five employees in Illinois, you are required to offer an employer-sponsored retirement plan). There are also new requirements being established constantly by these agencies (i.e., salary transparency on job postings in many states began in 2023). Using Mosey you can stay in compliance as your business grows and as state and local requirements change.

We integrate with all major payroll providers (80+ and counting).

Mosey offers different onboarding options for different plans. Self-serve takes minutes. More complicated businesses work with our customer success team to rapidly consolidate their systems and set up Mosey in a couple weeks.

Ready to manage compliance with a solution that scales?

Get a free consultation with our team of experts and learn how Mosey can manage it for you.

Select the right plan for your business

Choose the plan that best fits your multi-state compliance needs. From hiring the founding team to running a complex enterprise, Mosey has you covered.

Up to 15 states

Up to 30 states

Unlimited

Includes 1 registration/month*

Additional registration $150*

Includes 1 registration/month*

Additional registration $150*

Unlimited

Registered agent for up to 15 states

Foreign qualification $300

Annual reports $150

Certificate of Good Standing

Registered for up to 30 states

Foreign qualification $300

Annual reports $150

Certificate of Good Standing

Unlimited registered agents

Unlimited foreign qualification

Unlimited annual reports

Unlimited Certificate of Good Standing

Labor law posters

Monitoring and alerts

Policy generator

Handbooks ($2/employee/month)

Labor law posters

Monitoring and alerts

Policy generator

Handbooks ($2/employee/month)

Upcoming legislation

Labor law posters

Monitoring and alerts

Policy generator

Unlimited handbooks

Upcoming legislation

Plus multi-location employment and multi-entity configuration

Mailroom, electronic notices, logins, for up to 15 states

Mailroom, electronic notices, logins, for up to 30 states

Unlimited

Up to 5 hours/year**

Up to 10 hours/year**

$150/month

Plus priority SLA

Up to 15 states

Up to 30 states

Unlimited

Includes 1 registration/month*

Additional registration $150*

Includes 1 registration/month*

Additional registration $150*

Unlimited

Registered agent for up to 15 states

Foreign qualification $300

Annual reports $150

Certificate of Good Standing

Registered for up to 30 states

Foreign qualification $300

Annual reports $150

Certificate of Good Standing

Unlimited registered agents

Unlimited foreign qualification

Unlimited annual reports

Unlimited Certificate of Good Standing

Labor law posters

Monitoring and alerts

Policy generator

Handbooks ($2/employee/month)

Labor law posters

Monitoring and alerts

Policy generator

Handbooks ($2/employee/month)

Upcoming legislation

Labor law posters

Monitoring and alerts

Policy generator

Unlimited handbooks

Upcoming legislation

Plus multi-location employment and multi-entity configuration

Mailroom, electronic notices, logins, for up to 15 states

Mailroom, electronic notices, logins, for up to 30 states

Unlimited

Up to 5 hours/year**

Up to 10 hours/year**

$150/month

Plus priority SLA

- * Excludes county coverage OH, KY, PA

- ** Available with an annual or multi-year agreement

Ready to get started?

Schedule a free consultation to see how Mosey transforms business compliance.