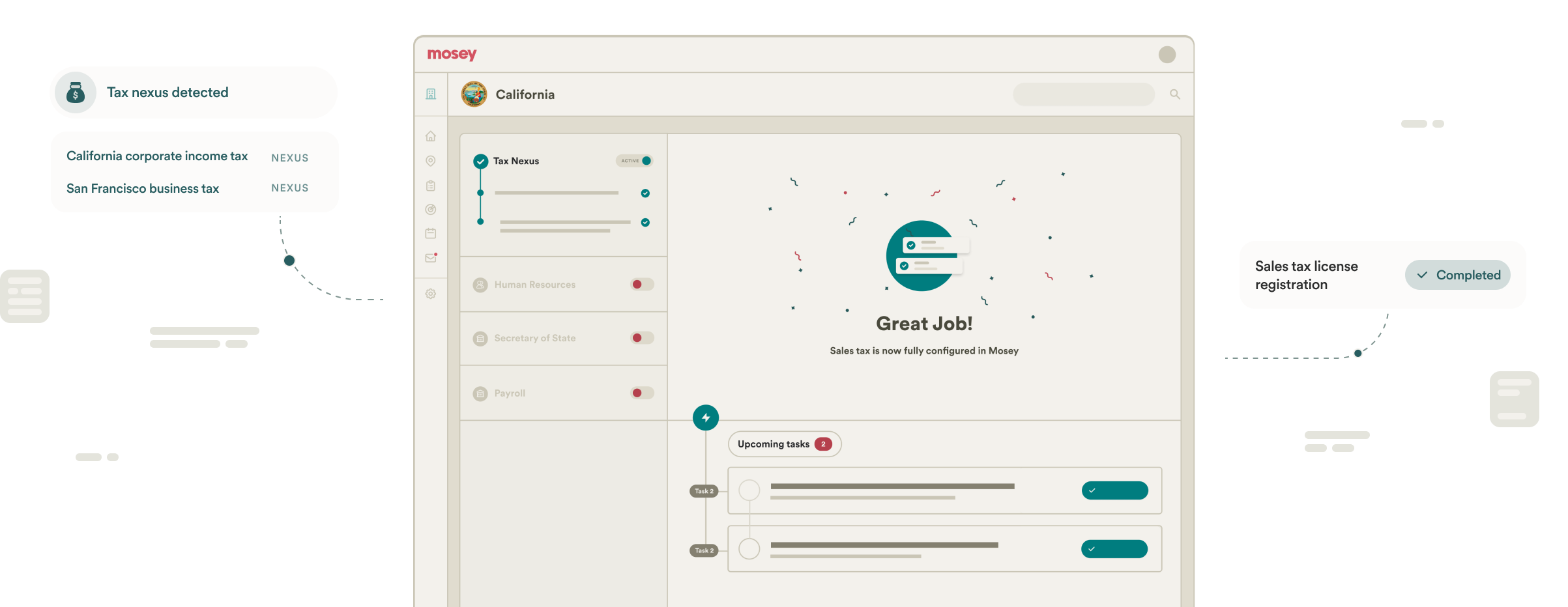

Automate tax nexus detection

Avoid costly penalties and fines by automatically detecting state and local taxes triggered by employees.

Trusted by

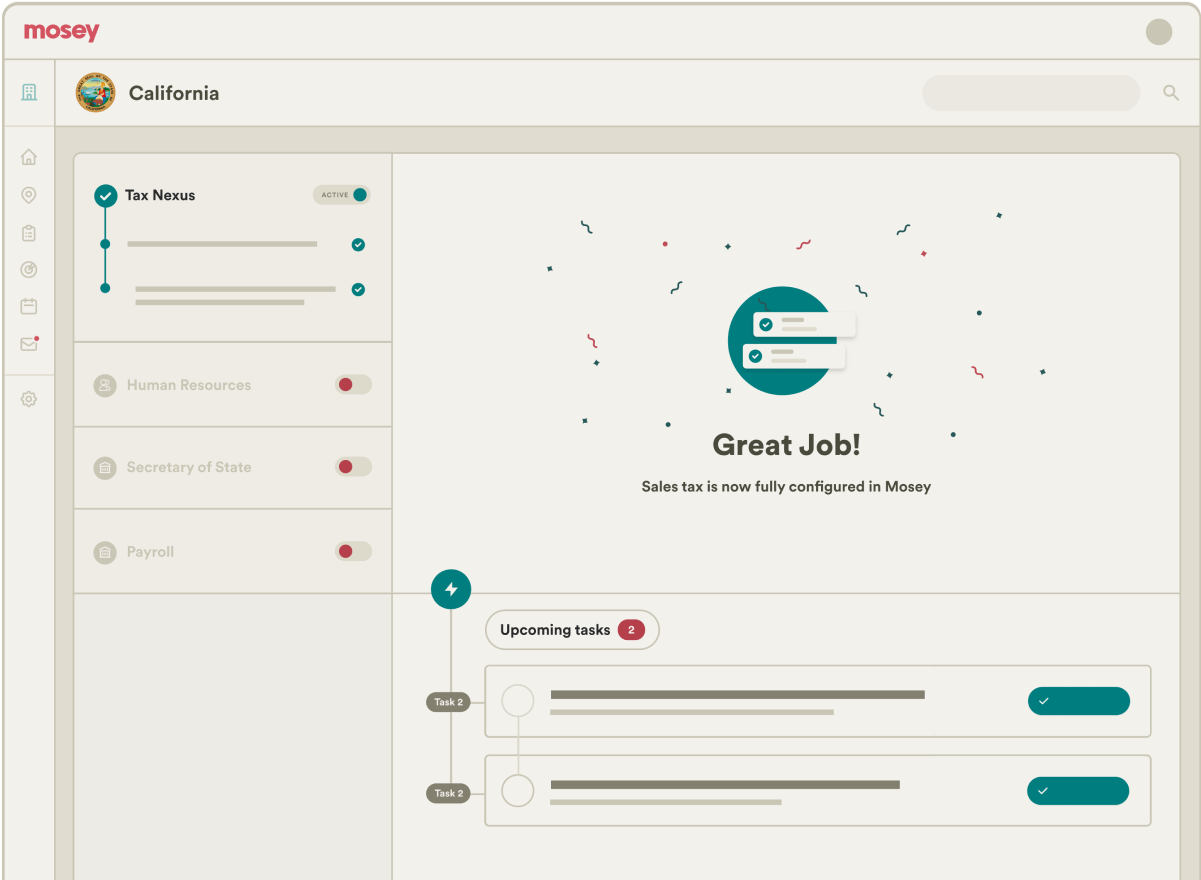

Monitor tax nexus

Connect HR data to automatically detect taxes when hiring in a new location or an employee moves.

Want to learn more about entity compliance?

Speak with a compliance expert to learn more about state and local taxes in all 50 states.

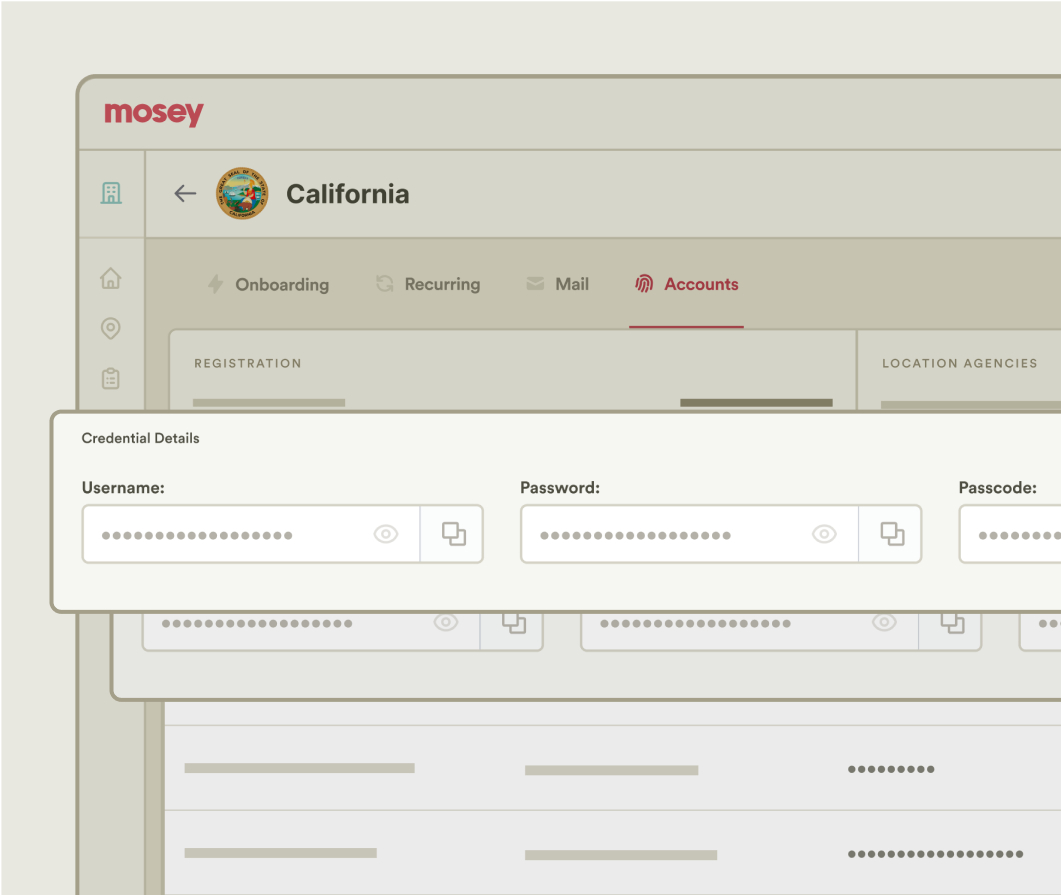

Get on top of taxes

Once registered, maintain your compliance with powerful automated systems for detecting new registrations, receiving mail, and accessing your agency accounts.

Accounting and finance teams can tax accounts they need to make payments and file reports securely in one place.

Automatically detect new state and local taxes when hiring in a new state or when an employee moves.

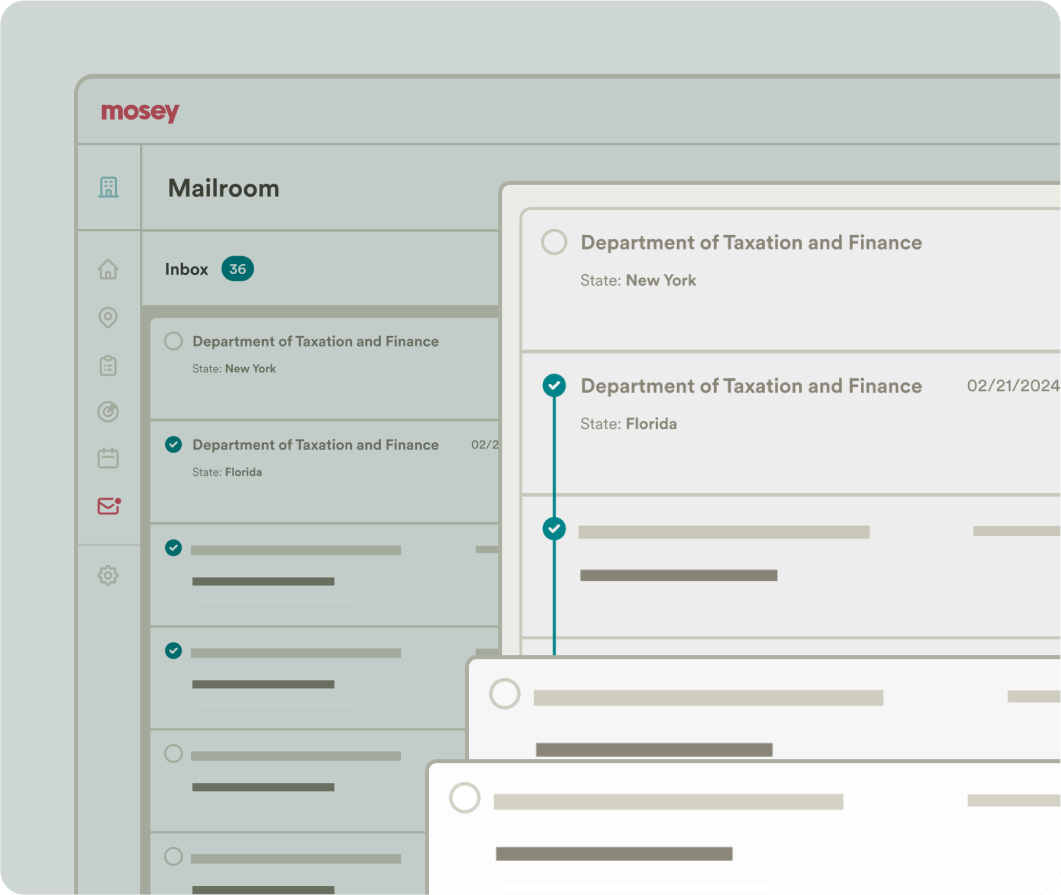

Check the mail right from your browser so you don't miss important notices and updates about taxes.

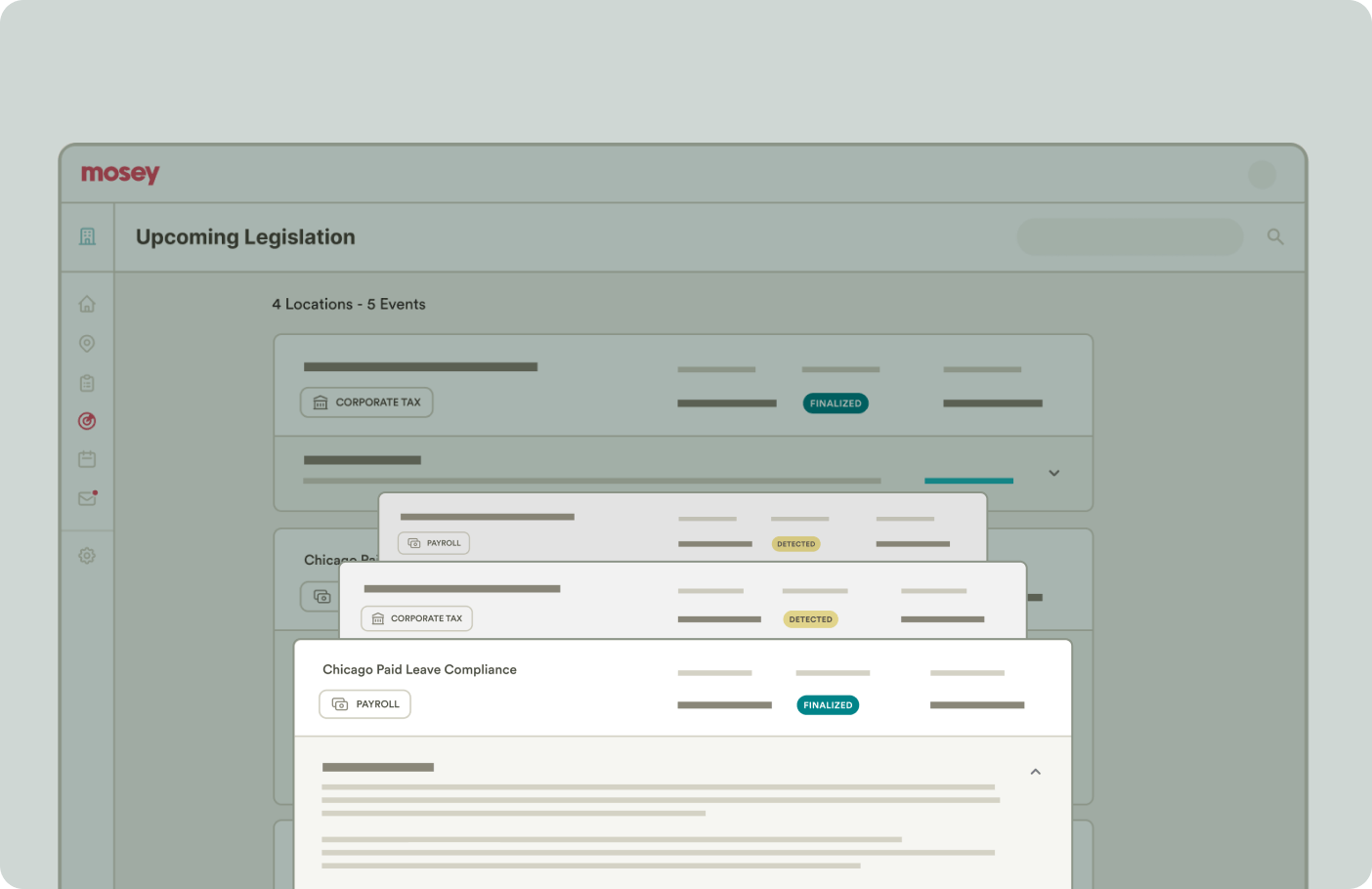

One platform for overall compliance

Tax is one of many compliance obligations a business must follow to operate in multiple locations. Bring it all together into one system with Mosey.

- Payroll compliance

- HR compliance

- Local compliance

- Entity compliance

Ready to get started?

Schedule a free consultation to see how Mosey transforms business compliance.