The Ultimate PEO Transition Guide: Leaving a PEO

Before leaving a PEO, learn to bring processes in-house, which critical services to implement, and how to remain compliant.

Transitioning off of a PEO? Our guide will teach you how to:

- Create an efficient PEO transition plan

- Take control of your employee data

- Find service providers for essential HR functions

- Maintain on-going compliance, in-house

- Determine which employee resources to create

- Select the right benefits provider

- Prepare for common transition challenges

Trusted by

Stay payroll compliant

Once registered, maintain your compliance with powerful automated systems for detecting new registrations, receiving mail, and accessing your agency accounts.

Automatically detect when employees move or a new hire shows up in a new location that requires registration.

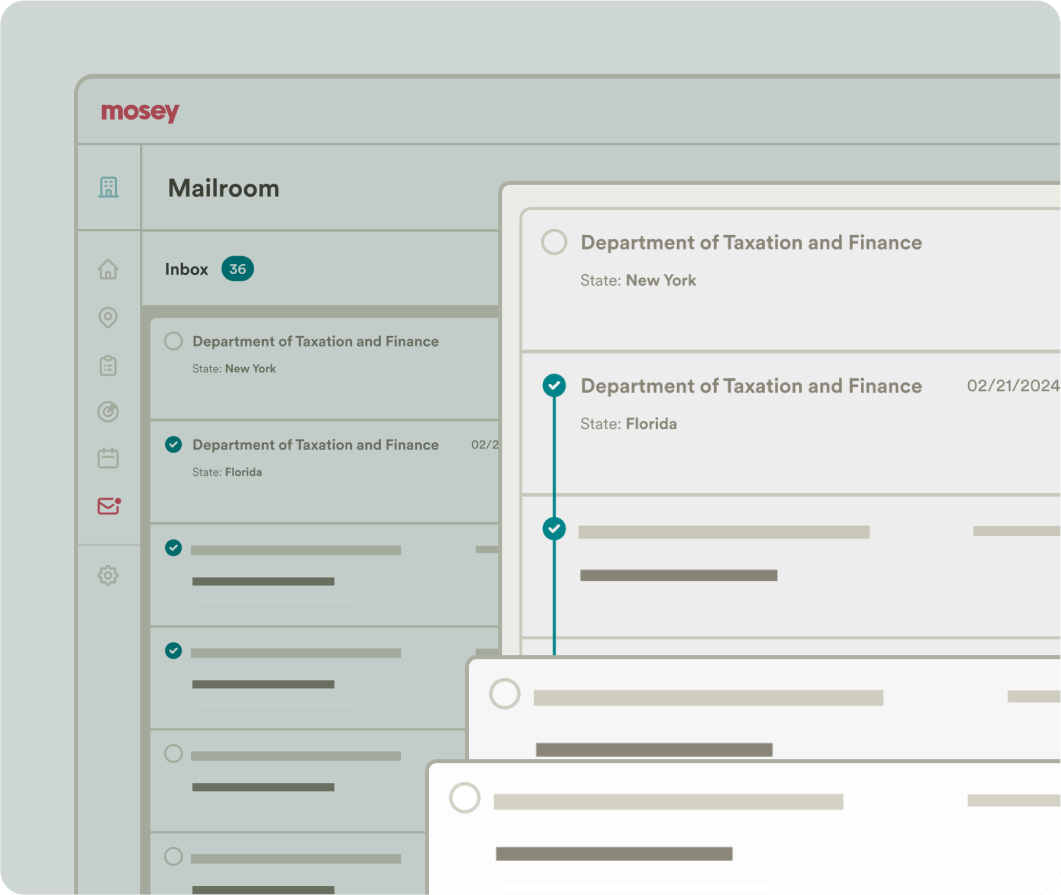

Receive letters and notices digitally so you don't miss important updates that can impact your compliance.

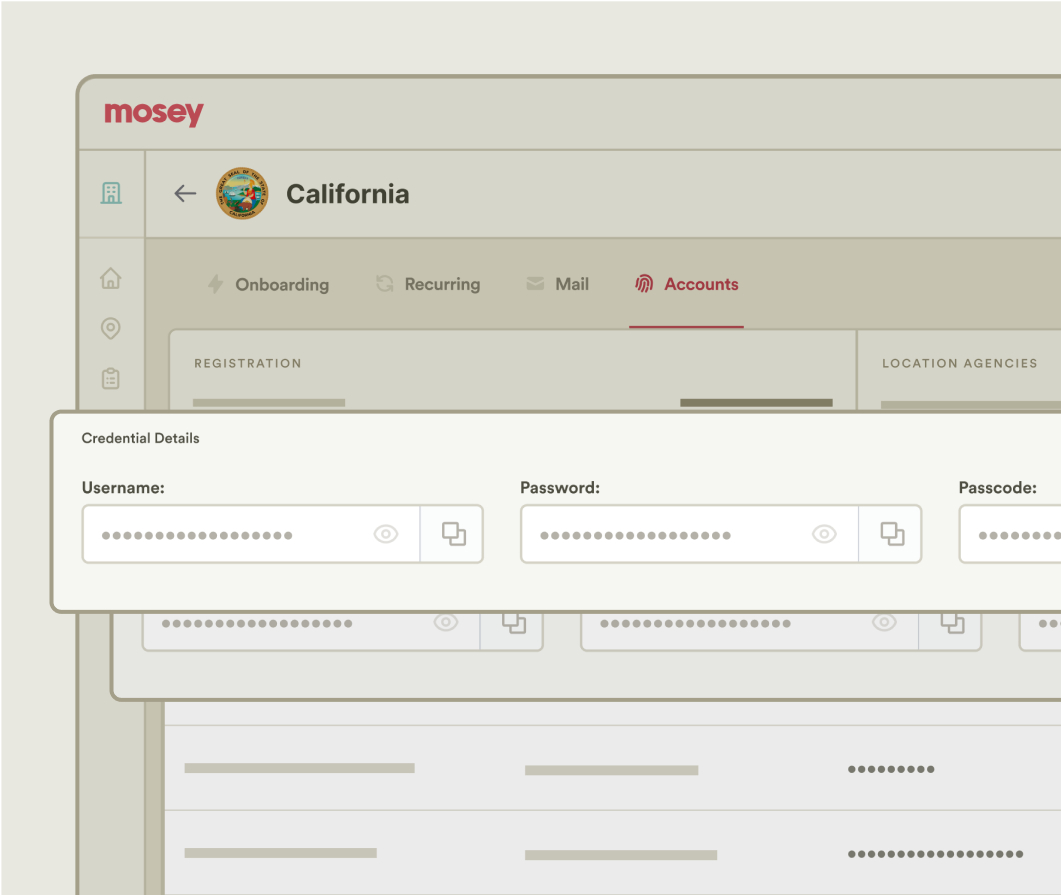

Store logins and securely share them with your team so you never lose access.

All the information you require

Mosey covers all 50 states, DC, and 1,000+ cities and counties.

Instead of receiving snail mail at your home or business location, you can receive mail virtually in your Mosey app. If you already have state accounts open, you can update those to start receiving your state mail in Mosey. When Mosey automates new accounts for you, we'll list your Mosey mailroom address. Additionally, you can make Mosey your Registered Agent for both existing registrations with the Secretary of State, or when automating foreign qualification in Mosey. You'll receive a notification whenever a new piece of mail is scanned and delivered to your mailroom. All mail can be downloaded as a PDF, or assigned to a member of your team. Most importantly, it is all kept securely in one spot so you'll never miss a notice.

You can import information for states you’ve already registered in, and Mosey will monitor new and recurring requirements for your business in those locations — and add more as you grow. But compliance is ongoing. As your business changes, you will hit new thresholds for state and local requirements (i.e., once you have five employees in Illinois, you are required to offer an employer-sponsored retirement plan). There are also new requirements being established constantly by these agencies (i.e., salary transparency on job postings in many states began in 2023). Using Mosey you can stay in compliance as your business grows and as state and local requirements change.

We integrate with all major payroll providers (80+ and counting).

Mosey offers different onboarding options for different plans. Self-serve takes minutes. More complicated businesses work with our customer success team to rapidly consolidate their systems and set up Mosey in a couple weeks.

Ready to get started?

Schedule a free consultation to see how Mosey transforms business compliance.