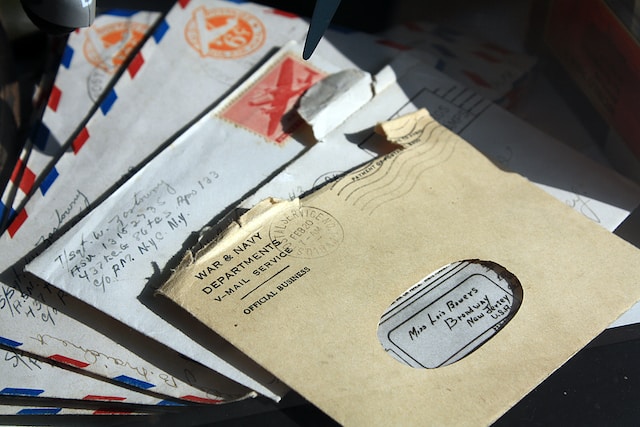

For most people, government and legal correspondence isn’t the world’s most exciting type of mail. It’s less fun than, say, an invitation to a swanky party or your most recent fruitcake-of-the-month club delivery.

For business owners, however, effectively receiving and handling these communications is a critical part of running a business. If you miss a notification, you might lose your ability to do business in a state or be unable to defend yourself against a legal action.

Maintaining a registered agent can ensure that your business receives and can respond to legal service or key government correspondence. In many cases, it’s also mandatory, meaning that maintaining a registered agent also represents an ongoing business compliance requirement—and failure to do so can result in penalties or fines against your business.

What is a registered agent?

Under United States business law, a registered agent is a person or entity authorized to receive government or legal correspondence on behalf of a company in a specific state.

The three main functions of a registered agent are as follows:

- Receiving government correspondence. Your registered agent will be the main contact for the Secretary of State in the state where the agent is located and will receive routine government correspondence, tax, and compliance-related communications on behalf of your businesses.

- Receiving legal documents. Your registered agent will receive service of process on your behalf in the state where the agent is located. In the event of a legal action against your business, a process server will deliver a summons, subpoena, or complaint to your registered agent.

- Forwarding communications to your business. Your registered agent will forward all communications to the appropriate person or persons at your business (such as the business owner, compliance manager, or business attorney).

Why would you need a registered agent?

Each state requires incorporated business entities—limited partnerships (LPs), limited liability partnerships (LLPs), limited liability companies (LLCs), and corporations—to designate a Registered Agent when registering with the Secretary of State. That means you need to appoint a Registered Agent in a state when you incorporate or foreign qualify there.

Who can be a registered agent?

Any person who is a resident in a state and maintains a physical address there can serve as a registered agent in that state. A domestic or foreign business entity with an office in a state can also serve as a registered agent there—with the caveat that a business entity that is foreign qualified in a state can’t serve as its own registered agent there.

In general, you have four options when appointing a registered agent:

- Appointing a business owner. If you need to obtain a registered agent in the state where you or another owner of your business lives, you can designate yourself or another business owner as your registered agent. Appointing a business owner is free—but before you choose this option, make sure that the appointed person will reliably be able to receive and handle key correspondence. Owners who travel for business or are frequently out of the office might not be the best choice.

- Appointing an employee. If you have a resident employee in a state where you need to appoint a registered agent, you can designate that employee to serve as your business’s registered agent. If you choose this approach, make sure that you trust the employee to receive and appropriately forward all communications, and consider what you’ll do if your employee goes on vacation or is otherwise out of the office. If your chosen employee leaves your company, you’ll need to appoint a new registered agent in that state.

- Third-party registered agent services. Many businesses choose to hire a registered agent service—either because they don’t have a resident in a state where an agent is required or because they want consistent services and hours. A good registered agent should be available to receive notice during standard business hours and promptly forward communications to the appropriate individual or office. Professional registered agent services can be individuals or companies, including out-of-state companies who are foreign qualified in a state and maintain an office there. These services usually cost around $150 per state per year.

- Mosey. Along with automating other aspects of the foreign qualification process, Mosey’s compliance platform can act as your registered agent. The app automatically notifies you when there’s an important letter from any state agency, and you can view the mail right from your web browser—giving you faster access to correspondence than you get with a traditional third-party service. Mosey includes being your registered agent as part of your existing platform subscription, so there is no additional cost per state like there is with third-party registered agent services. This makes the platform more cost effective than using a 3rd party service.

Note you can change your registered agent at any time by filing change statements with the Secretary of State, so if you choose one type of registered agent but find it’s not working for you, you can always switch to another approach.

Registered agent vs. resident agent and other similar terms

Different states may use different terms to refer to registered agents. Common names include the following:

- Resident agent

- Statutory agent

- Agent for service of process

Depending on the state, you might also encounter the term “registered office,” which refers to the physical address of your registered agent (or resident agent, statutory agent, or agent for service of process, depending on your state’s terminology).

Potential consequences of not having a registered agent

Obtaining a registered agent is relatively simple, but the costs of not having one can be severe. Here’s an overview of potential consequences.

- Loss of good standing. In some states, failing to maintain a registered agent can result in fines and cause your business to lose good standing, which can prevent you from opening a business bank account, securing a loan, or registering to do business in other states.

- Judgments against your business. If a process server can’t deliver the service of process to your registered agent, the server can obtain permission to serve you via other methods or to serve the Secretary of State instead. If this happens, there’s no guarantee that you’ll know you’ve been served. If you don’t see the service and don’t respond, courts can issue a default judgment against your business.

- Missed report filings. Some states will send annual report documentation to your business’s registered agent. If you don’t have a registered agent, you won’t be able to file your annual report, which can result in a loss of good standing or the dissolution of your business.

- Fines. Some states impose fines on businesses that fail to maintain a registered agent in the state.

- Suspension of your license or dissolution of your business. A state may suspend your business license or even dissolve your business if you don’t have a registered agent in the state.

Mosey’s compliance platform streamlines the process of obtaining and maintaining a registered agent in every state where you do business. Make Mosey your registered agent for all states and receive all state mail directly into the app in the Mail section. View, assign, and resolve letters directly within Mosey so your whole team can collaborate and complete state compliance tasks. The best part? The cost of our services is included with your subscription.

Read more from Mosey:

- LLC Annual Report: What It Is, What’s Included & How to File

- With Paid Family and Medical Leave: 2023 Guide

- What Is Multi-State Payroll?

- Is Workers’ Comp Insurance Required in NY?

- Salary Transparency Laws & Best Practices in 2023

- Certificate of Good Standing: The Business Owner’s Guide to How and Why

- Why Incorporate in Delaware? Pros and Cons for Startups

- What Is FUTA? How to Comply With the Federal Income Tax Act

- LLC vs. S-Corp: What Are They & How They Work