Methodology & Definitions

Mosey surveyed U.S. HR and finance leaders on the growing complexity and cost of managing multi-state compliance. Between remote workers and teams scattered across different states or even countries, many leaders struggle to develop and maintain control and confidence in their compliance operations.

This report defines these critical concepts as:

- Control: Managing and directing compliance processes proactively

- Confidence: Certainty that an organization is meeting its compliance obligations

The data shared throughout this report was collected through survey responses from HR and finance leaders across multiple industries and company sizes. Mosey conducted the survey from April-August 2025 and analyzed responses into the industry data presented herein.

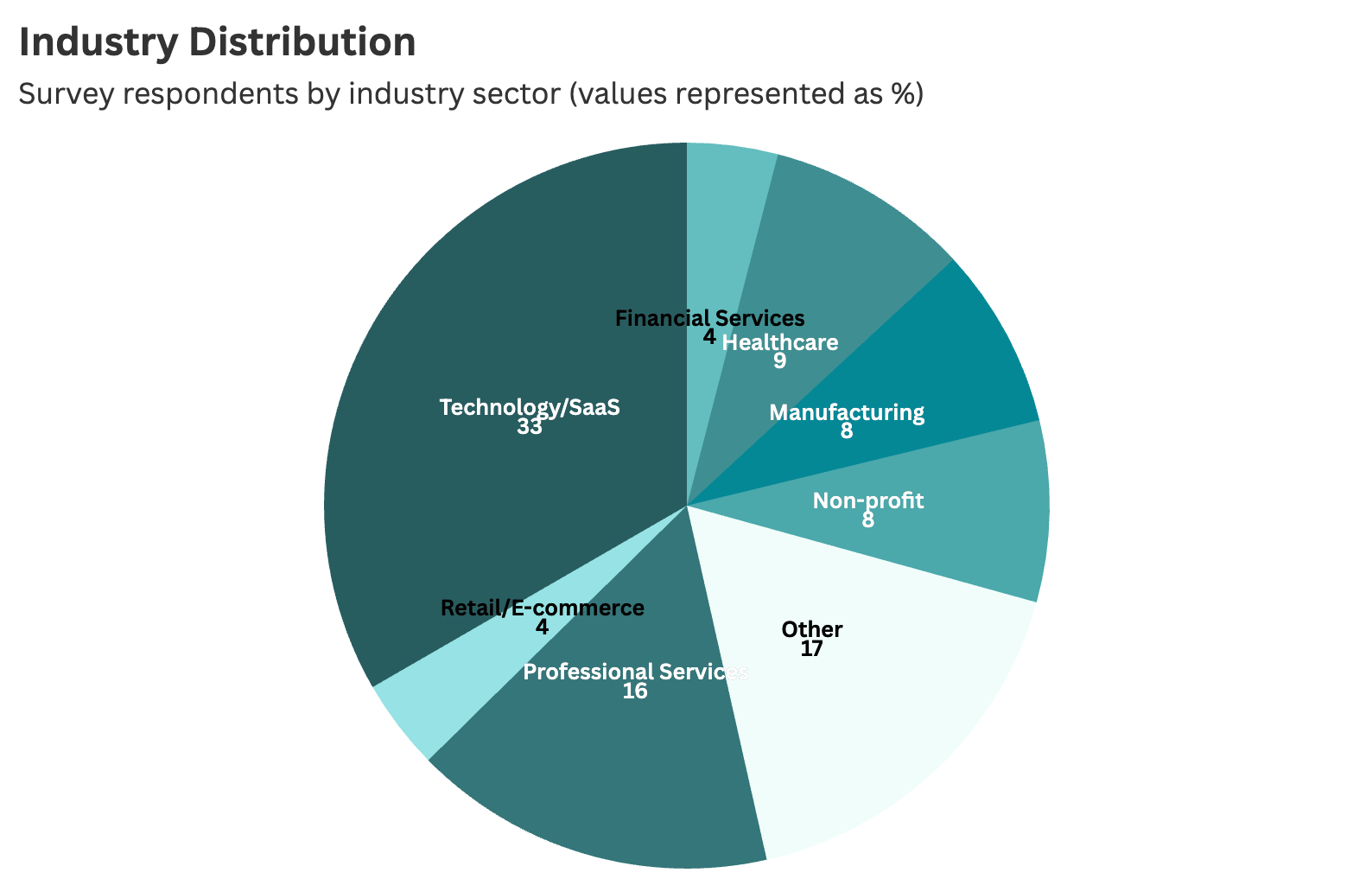

Industry Distribution

Respondents identifying as technology/SaaS companies were most prevalent in the report, comprising 33% of total respondents, followed by Professional Services (16%), Healthcare (9%), Manufacturing (8%), and others.

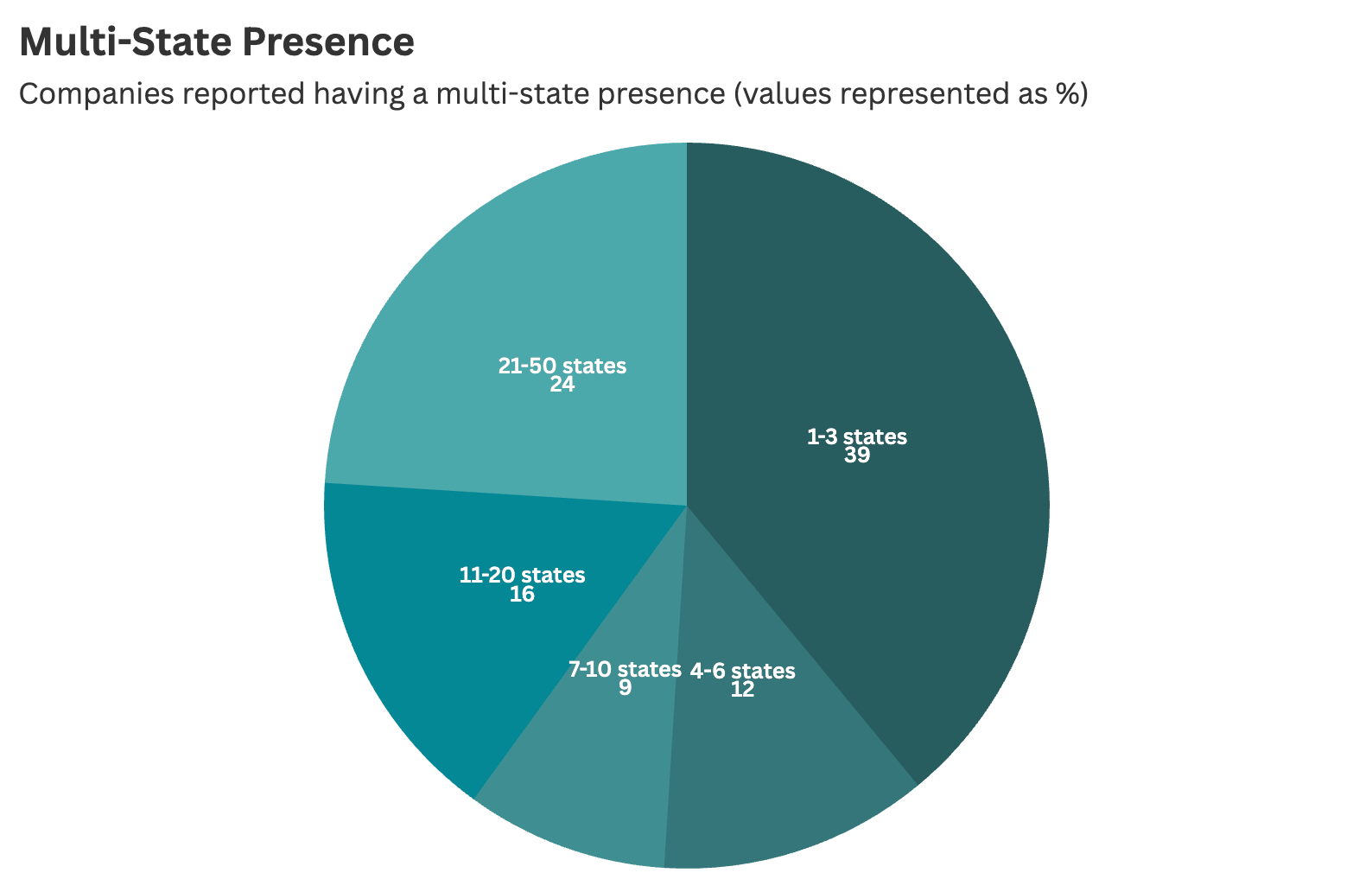

Respondent organizations ranged from small businesses to enterprises, with 39% operating in 1-3 states and 24% operating in 21-50 states, highlighting the universal challenge of multi-state compliance, regardless of company size.

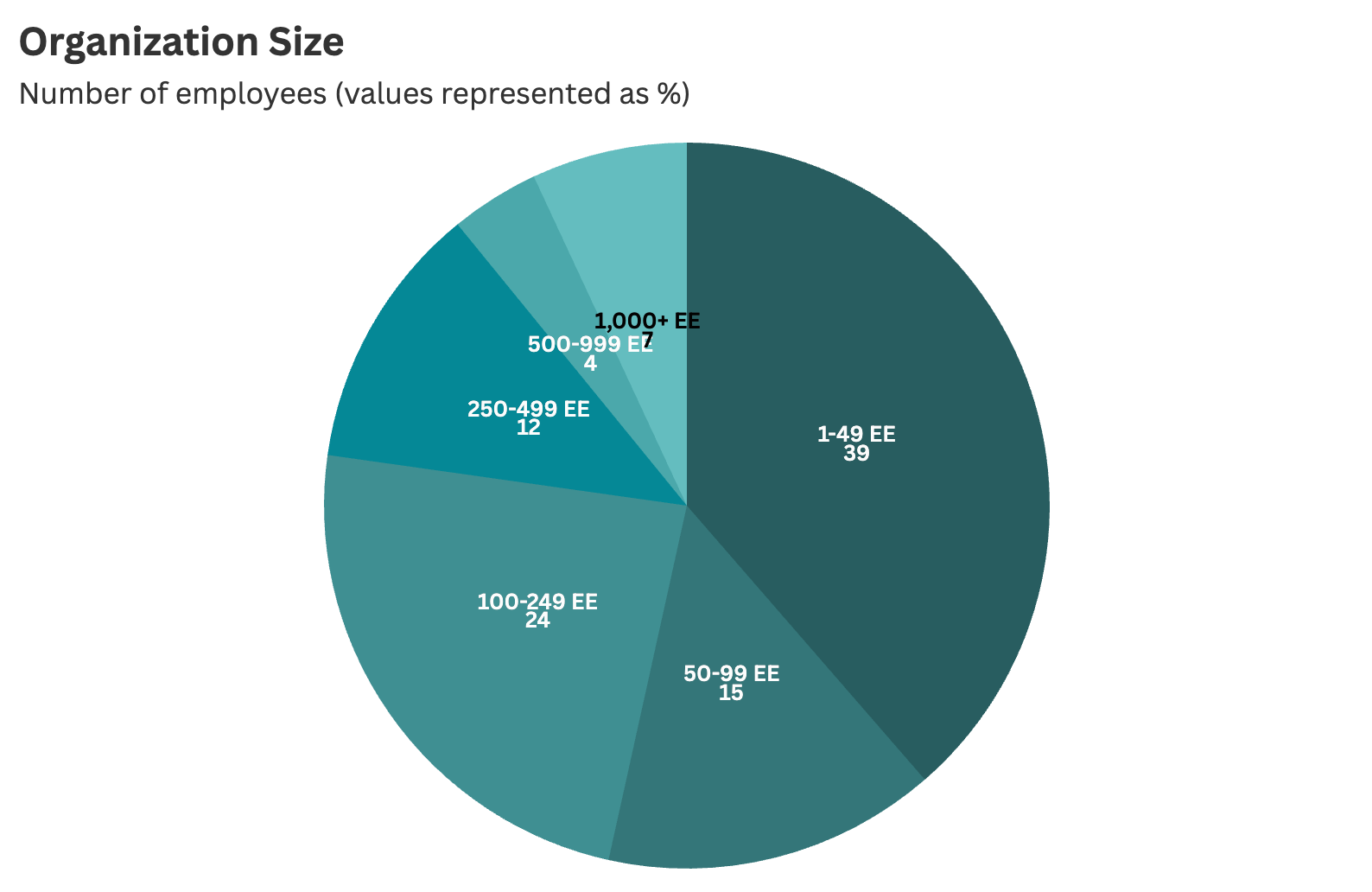

Independent of their national spread, these organizations also demonstrate a breadth in employee size, with 39% of companies represented having 50-249 employees and 23% having over 250 employees.

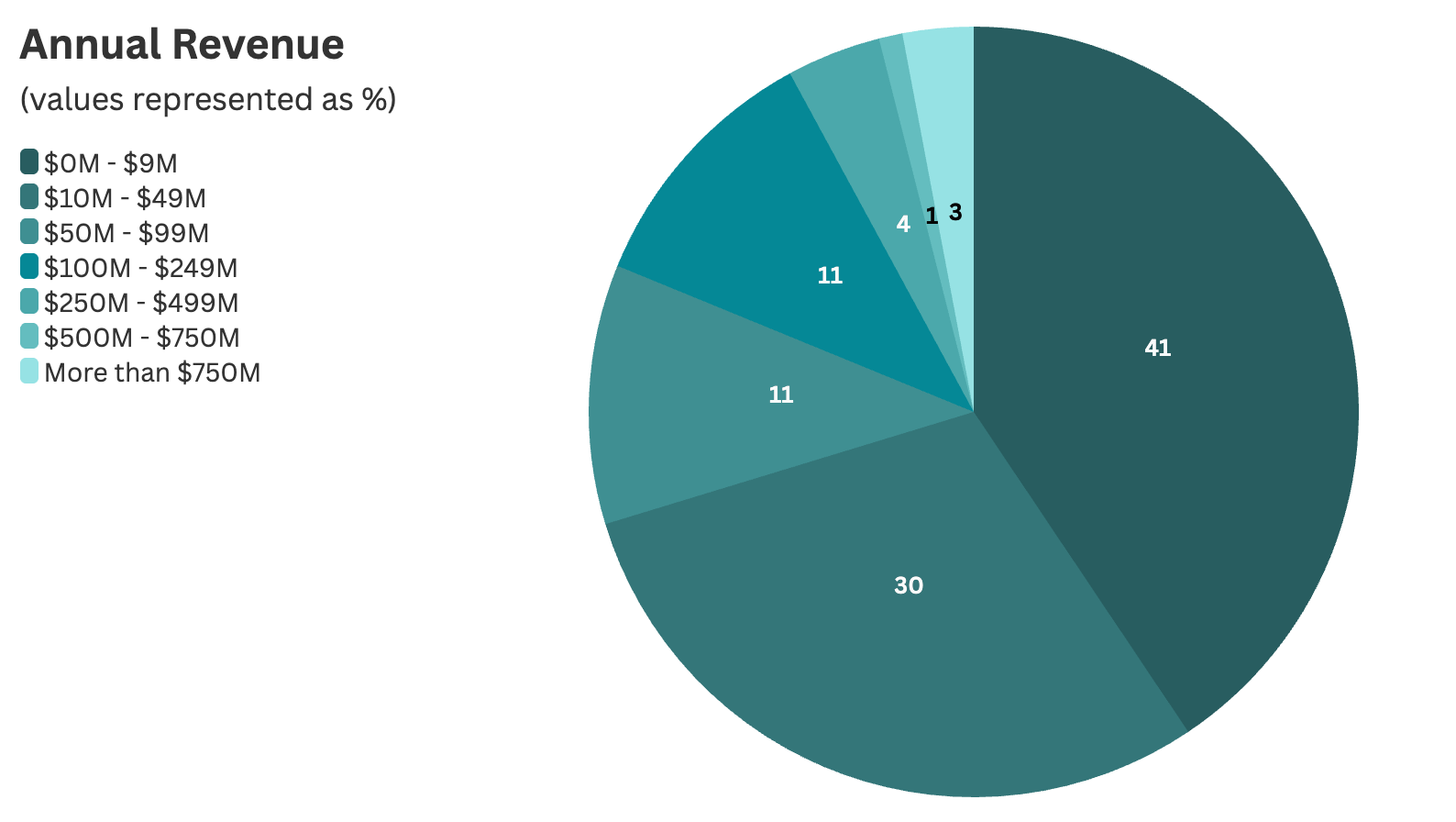

We gathered data from a wide range of revenue stages as well, from the largest group under $10 million to nearly 20% of businesses who have surpassed the $100 million annual revenue mark. Compliance is a priority and a challenge at every stage without the right understanding and systems in place.

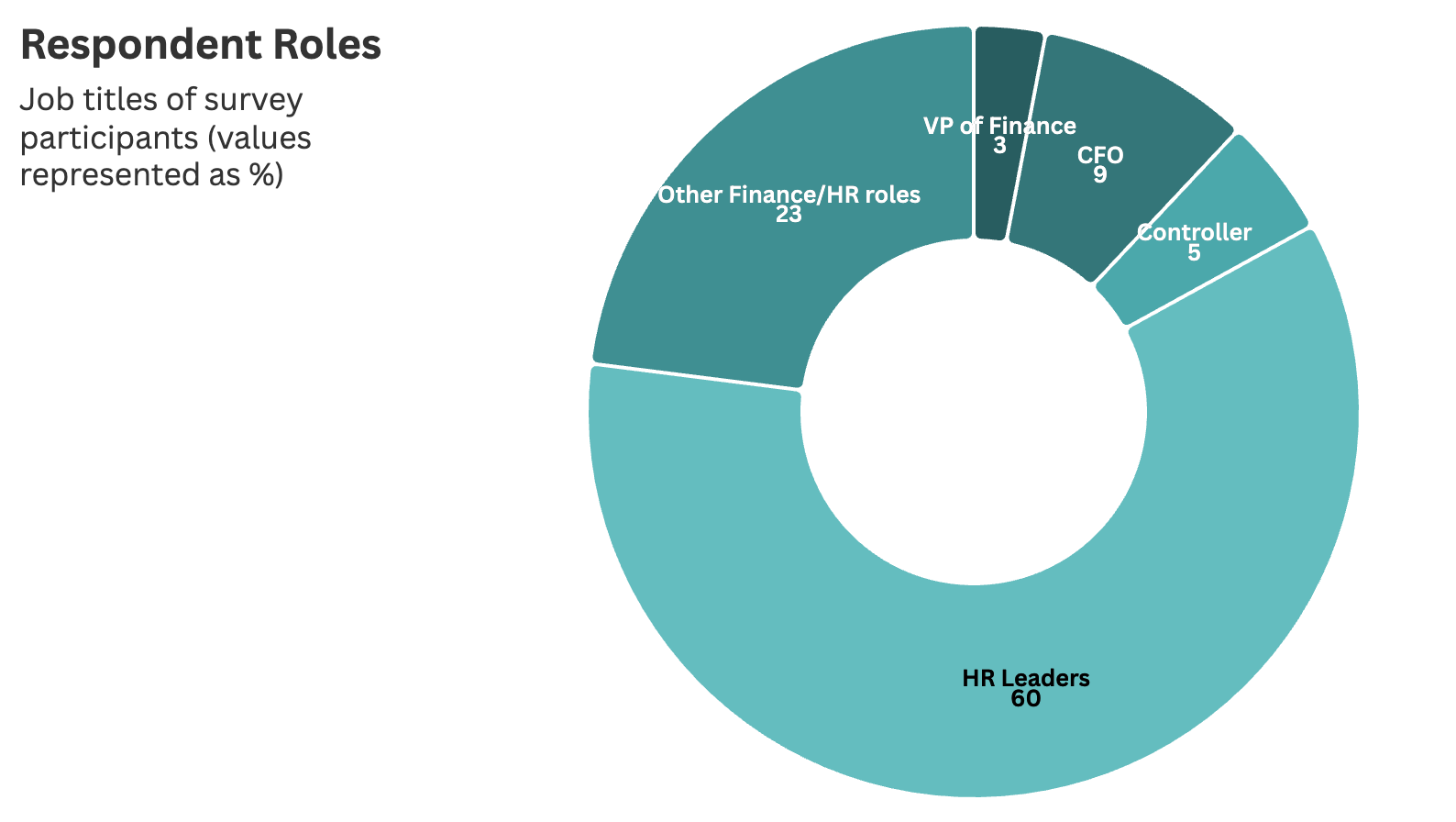

Among our HR and finance participants, the majority of compliance responsibilities sit with the HR leaders in these organizations at 60% of participants. Common finance roles of CFO, VP of Finance, and Controller occupy another 17%. The remaining 23% of respondents handling compliance for their organization have various titles within HR and finance management to senior management levels.

Key Findings

- Only 21% of leaders are highly confident in their compliance status, despite investing significant time and resources into compliance management.

- 53% report increased team stress and burnout from managing compliance, as manual processes and multi-state complexity take their toll on staff wellbeing.

- Companies rely on 4+ disconnected tools, with 55% still using spreadsheets to track critical compliance obligations across states.

- 33% still incurred penalties in the past year, proving that fragmented tools and manual processes aren’t preventing costly compliance failures.

- 11% of leaders are unable to pursue growth opportunities due to compliance challenges.

- Over two thirds of respondents shared they would be able to focus more on growing the company if they could worry less about compliance.

Download the 2025 report

Get your free copy of this year’s industry benchmark report outlining the strategic compliance insights from HR and Finance leaders.

Mosey Insight: Remote work and geographic expansion have created compliance challenges that traditional approaches can’t handle. Yet most organizations are still relying on manual processes and disconnected tools, creating a dangerous gap between complex compliance needs and their ability to manage them.

1. The Current State of Compliance Management

Too Many Disconnected, Archaic Tools

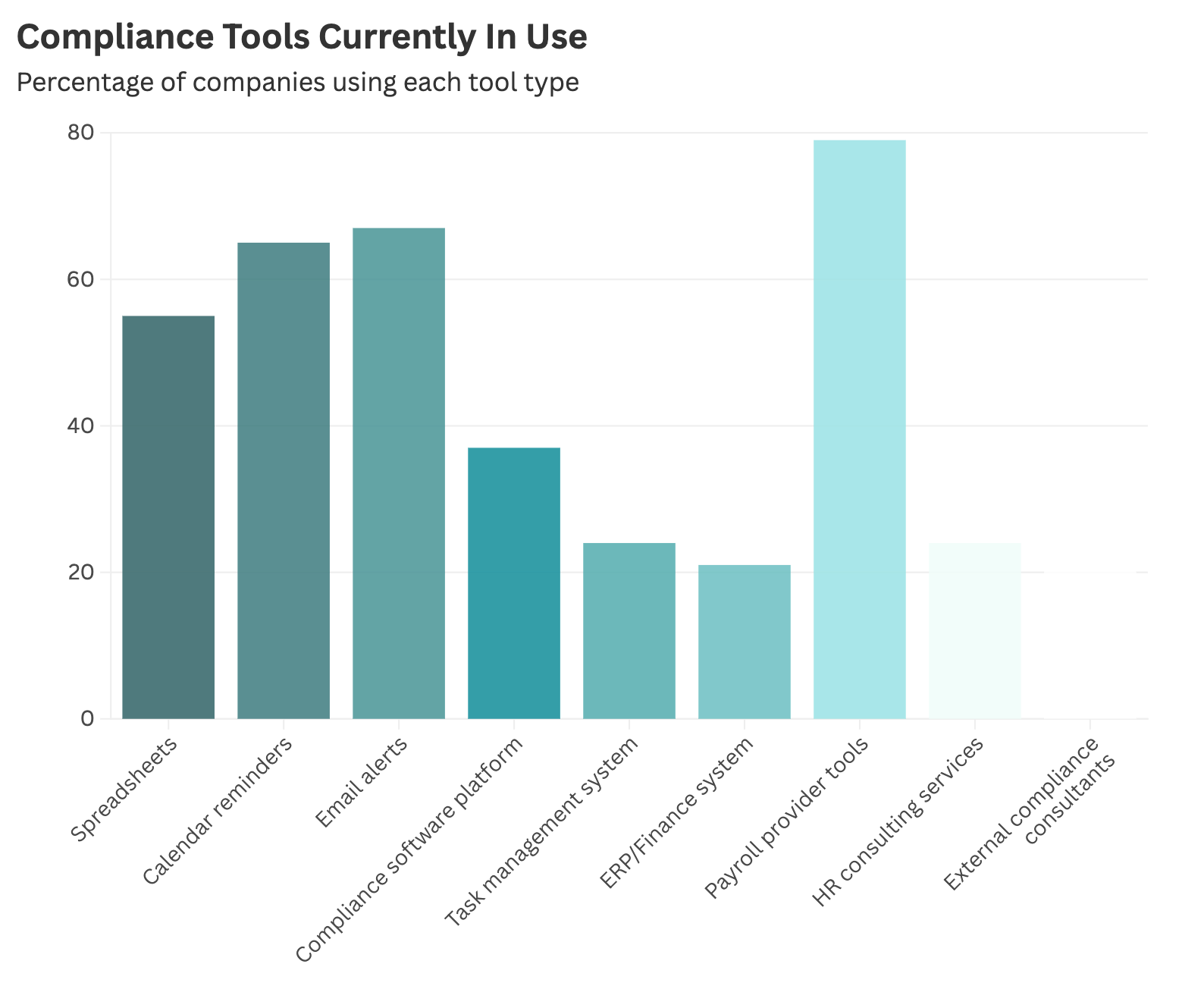

Most HR and Finance leaders rely on multiple tools to handle tax, payroll, and labor compliance. While these tools provide critical support, many teams still manage compliance manually through spreadsheets, email alerts, and calendar reminders.

- Companies use an average of 4+ different tools to manage compliance

- 55% rely on spreadsheets for tracking at least some compliance obligations

- 65% rely on calendar reminders, and 67% depend on email alerts as the primary means for staying on top of news and to-dos

- Only 37% have implemented a compliance software platform, with 63% relying on a patchwork of general business tools and manual processes

With this insight into the operations of many multi-state teams, it’s no wonder that compliance is a headache. Without the proper infrastructure and expertise in your tools, you are setting your business up for reactive, potentially costly, compliance management.

The End Game: Unified, Centralized Compliance Management

Managing compliance across multiple states gets incredibly complicated when systems are disconnected. Finance, HR, and Legal teams often operate in silos, with compliance data scattered across spreadsheets, email reminders, payroll software, and tax portals.

Without a unified system, compliance teams face:

- Operational inefficiencies: Teams waste time tracking down data across multiple tools

- Higher compliance risks: Key deadlines and filings are missed when information is fragmented

- Reactive management: Instead of proactively handling compliance, teams are constantly scrambling to fix things after the fact

Organizations improving compliance operations are moving toward centralized systems:

- Integrated Compliance Platforms: Forward-thinking teams are consolidating compliance tracking into unified systems

- Better Tool Integration: 79% already use payroll provider tools, but need better integration with other compliance systems

- Centralized Oversight: Creating single sources of truth instead of several disconnected tools

Companies that move from fragmented systems to a centralized approach free up valuable time, reduce compliance-related errors, and gain the ability to manage compliance proactively rather than reactively.

2. The Control Challenge in Multi-State Compliance

From Firefighting to Prevention

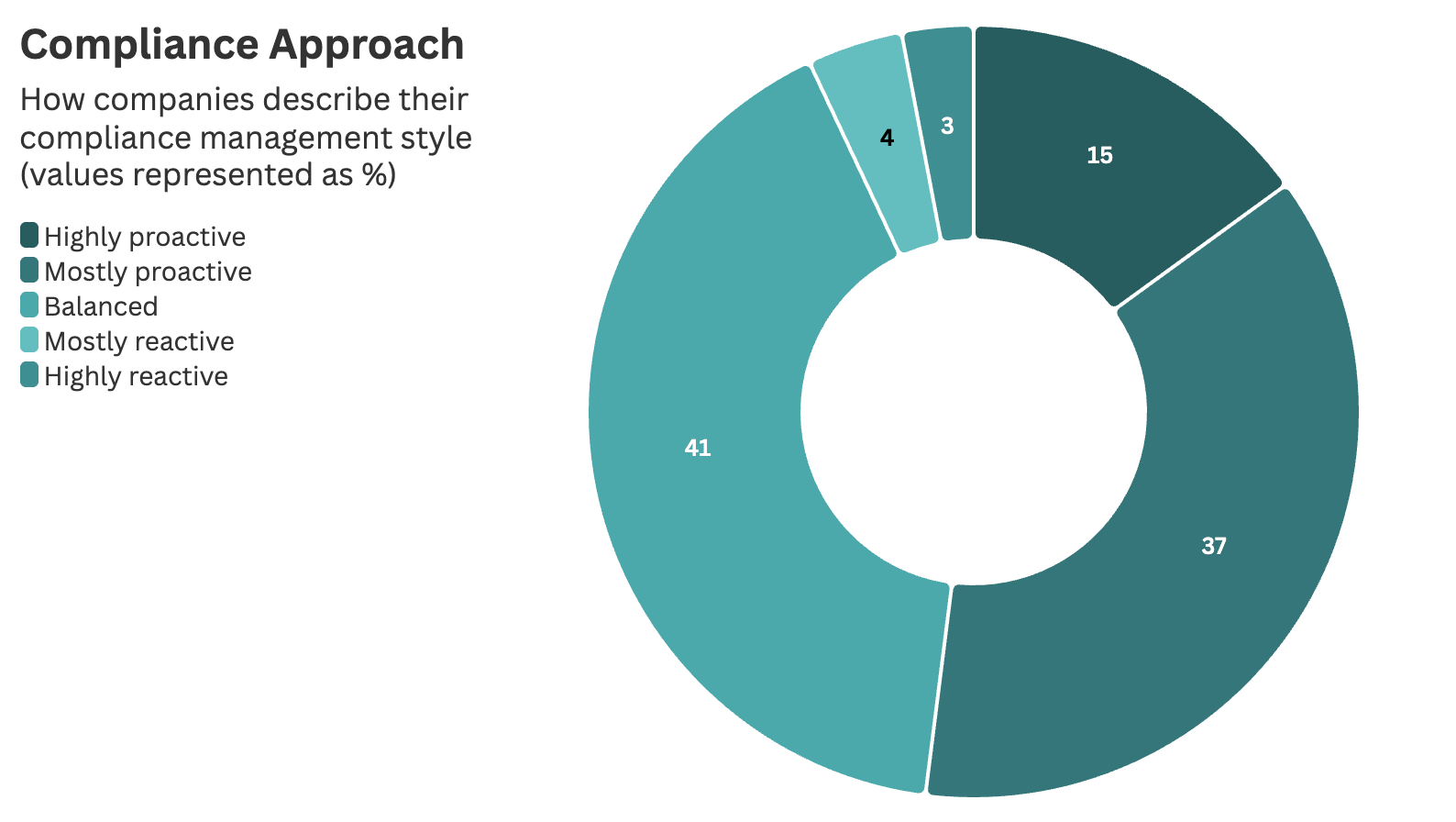

The majority of teams know reactive compliance doesn’t work, yet few have successfully made the shift to true prevention.

- Just 15% describe their compliance approach as “highly proactive”

- Only half (52%) take a proactive or mostly proactive approach

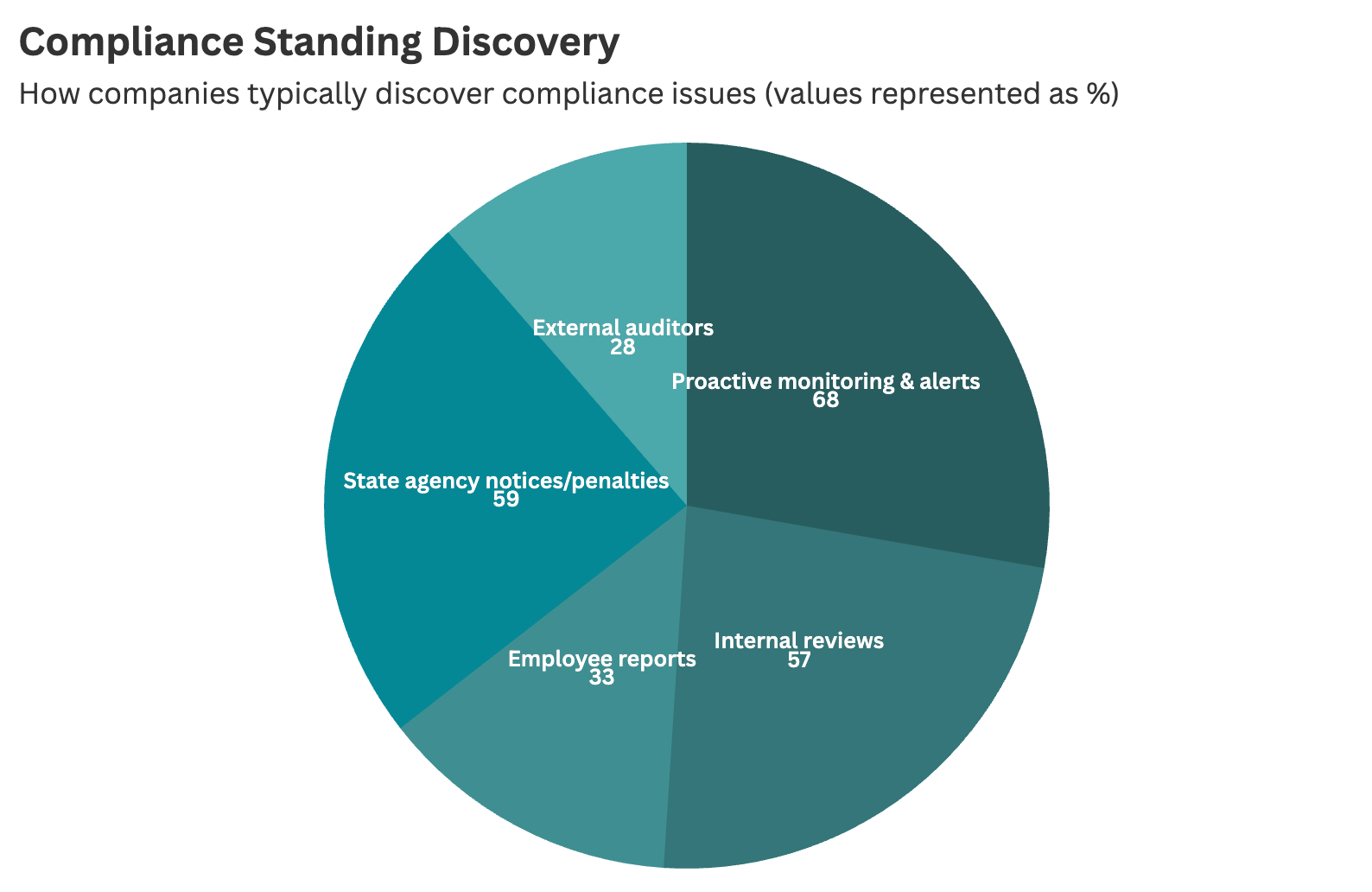

- 59% still discover issues through state agency notices or penalties, finding out about problems the hard way

85% of businesses typically discover issues from audits, either internally reviewed or from external parties. Regularly reviewing your systems and adjusting compliance needs according to business growth is a critical piece.

Of the highly proactive compliance teams, all of them, that’s 100%, use a proactive monitoring and alerting system like Mosey.

Where Compliance Processes Fail Most Often

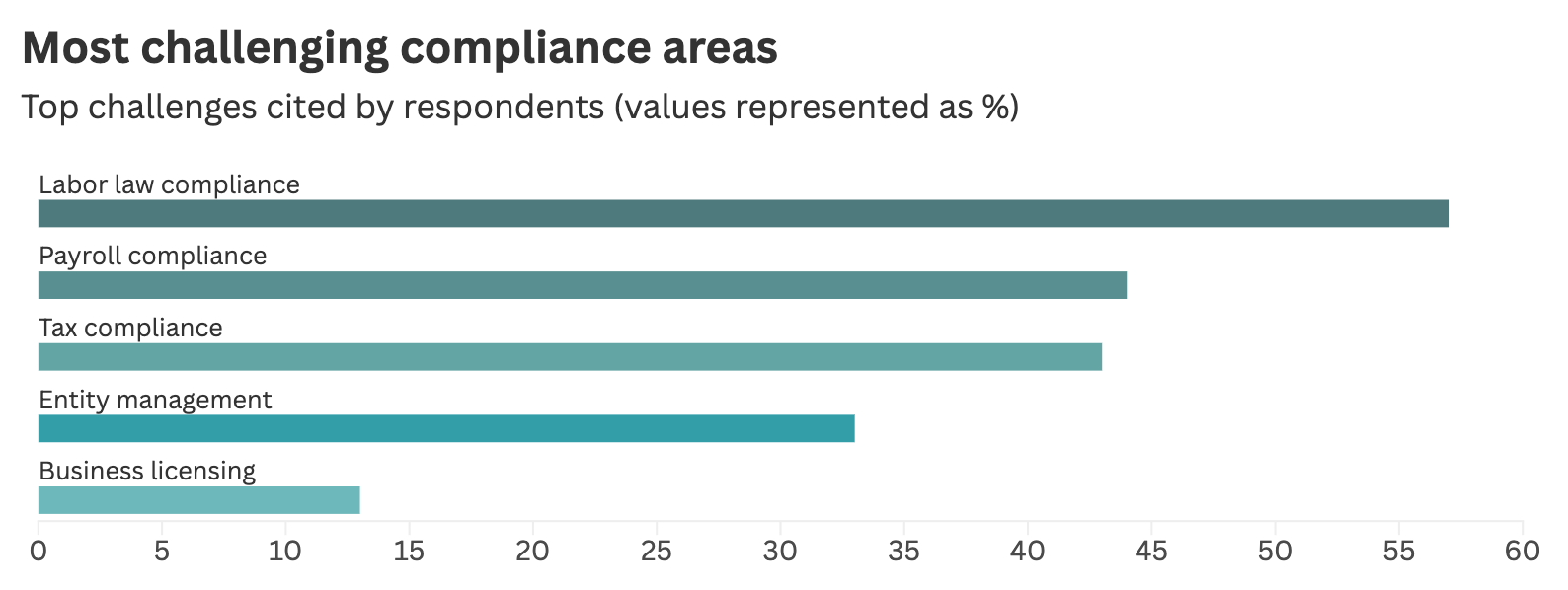

HR and Finance leaders identified specific areas where control is most challenging:

- Labor Law Compliance: 57% cite this as a top challenge, struggling to track varying state employment regulations, worker classification rules, handbook policies, and required notices

- Payroll Compliance: 44% report difficulties managing tax registrations and accounts, including withholding requirements and unemployment insurance, across states

- Tax Compliance: 43% lack systematic controls for monitoring and addressing multi-state tax obligations

- Entity Management: 33% struggle to maintain timely Secretary of State filings, registered agent services, and remain in good standing

Business Disruptions from Process Failures

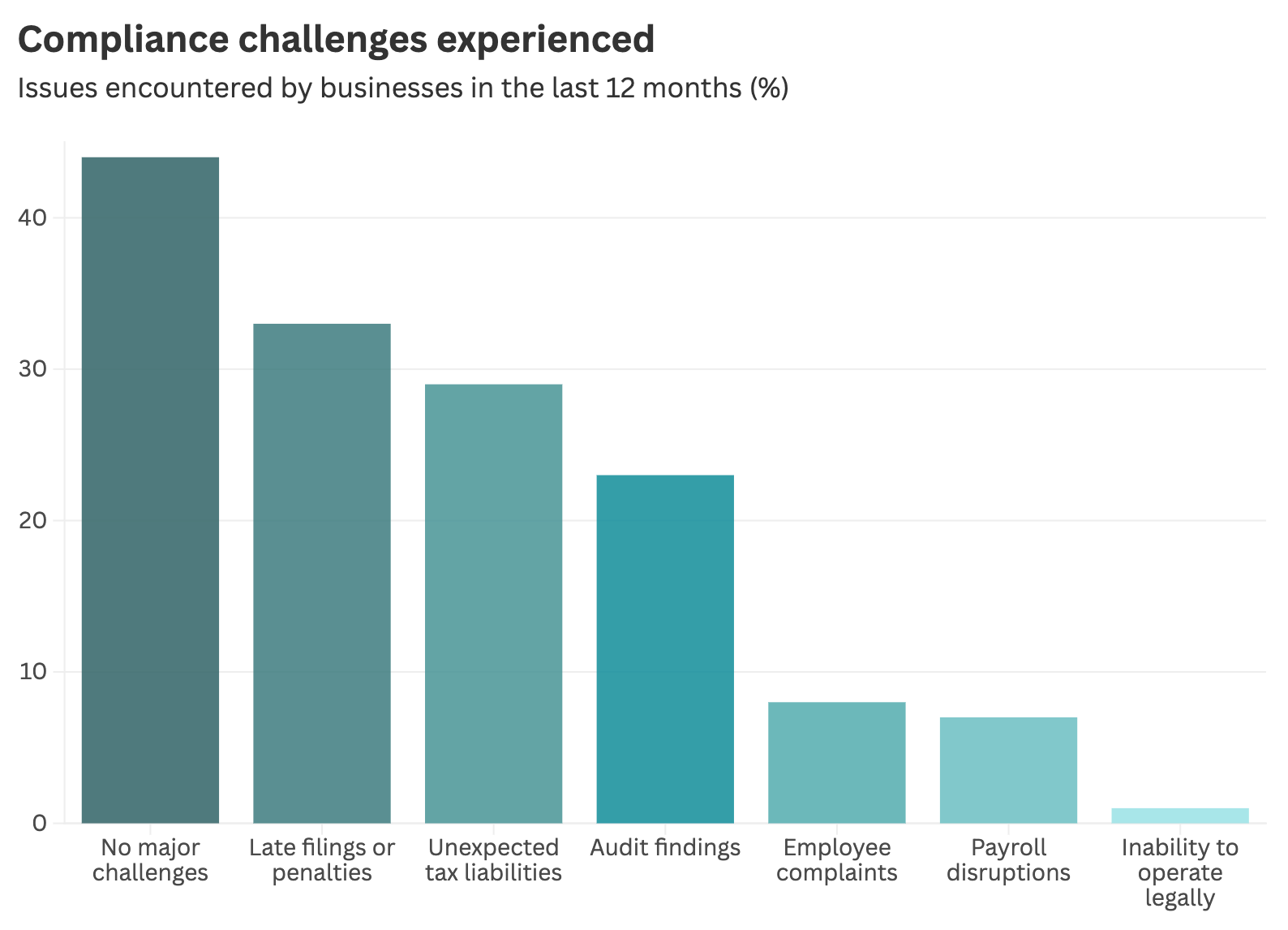

Despite efforts to maintain control, compliance gaps still create operational challenges:

- 33% experienced late filings that resulted in penalties, even with reminder systems in place

- 29% encountered unexpected tax liabilities due to missed requirements or changes

- 23% had audit findings that revealed previously unknown compliance gaps

- Notably, 44% avoided major compliance challenges in the past year—showing that strong processes can work

Mosey Insight: While many organizations have moved beyond purely reactive approaches, the many layers of multi-state compliance still catches teams off guard. Even companies with proactive intentions struggle with execution—57% find labor law compliance challenging despite their best efforts. Unfortunately, good intentions aren’t enough. Businesses need systems that can ensure nothing falls through the cracks across dozens of state requirements.

3. The Confidence Crisis in Compliance

Growing Uncertainty in Compliance Status

Despite investing time and resources into compliance management, most leaders lack true confidence in their compliance status.

- Only 21% express high confidence in their organization’s current compliance status

- 51% are somewhat confident, suggesting lingering doubts even among those who feel relatively prepared

- Nearly 11% lack confidence entirely, operating with significant uncertainty

What Keeps HR and Finance Leaders Up at Night

Leaders identified several factors undermining their compliance confidence:

- 51% worry about unknown unknowns—compliance requirements they aren’t even aware exist

- 43% cite increasing complexity of regulations as confidence-eroding

- 41% struggle with tracking regulatory changes across multiple states

- 36% lack sufficient internal compliance expertise to feel truly confident

- 28% say expansion into new states reduces their confidence

- 25% lack confidence in handoffs between HR, Finance, Payroll, and Legal departments

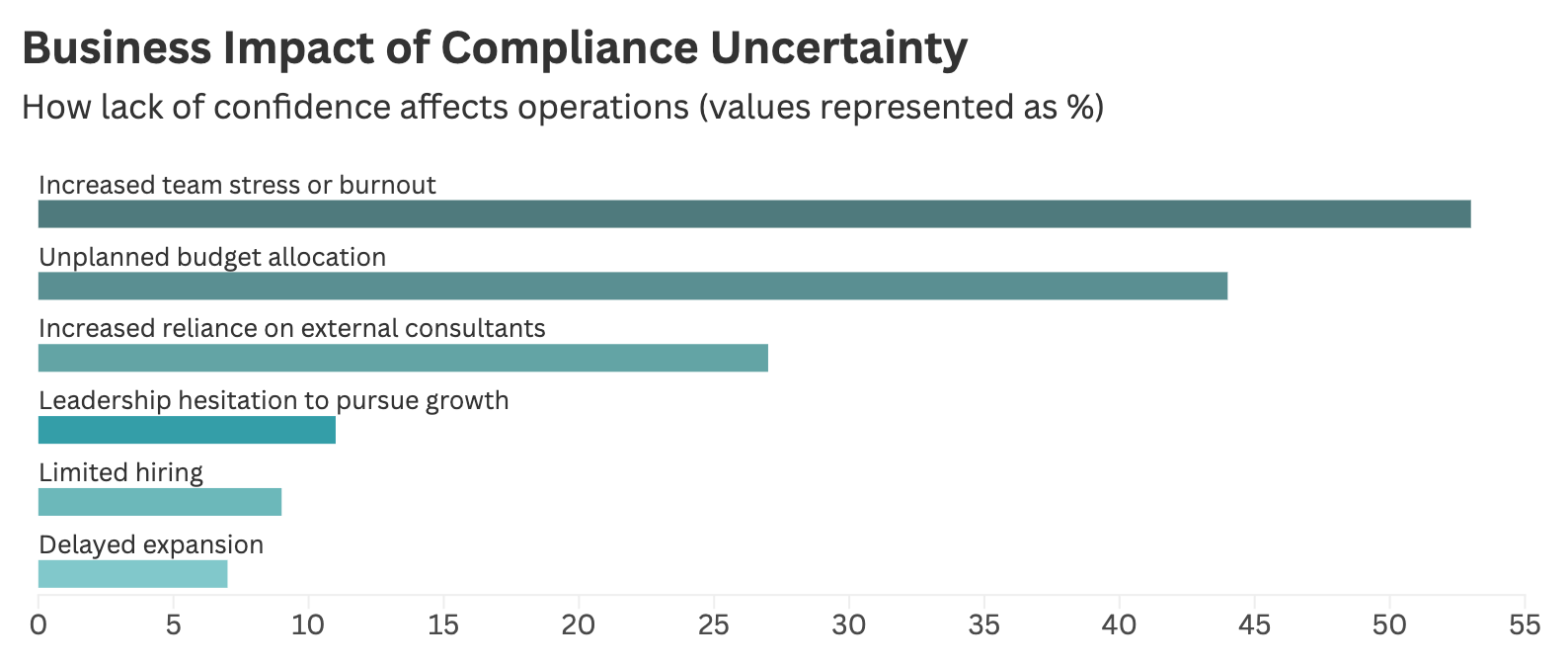

How Uncertainty Limits Business Growth

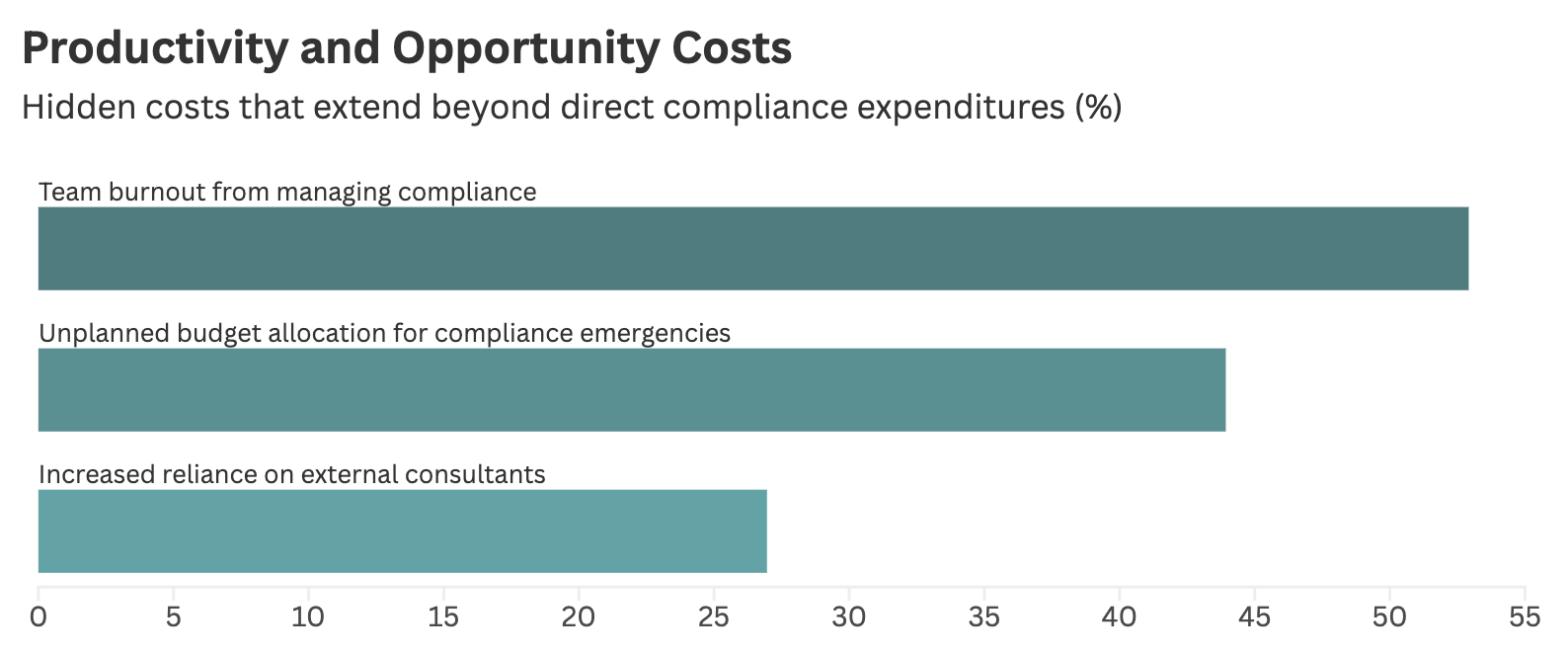

More than half of companies report increased stress and burnout on their teams, the highest business impact cited and one of the most critical. When good people leave, it adds additional burden to the remaining employees, and takes time to hire into that role again.

- 44% have made unplanned budget allocations to address compliance emergencies

- 27% increased their reliance on external consultants to validate compliance status

- 73% would feel confident growing if compliance wasn’t a factor, yet only 3% are actually prioritizing expansion, showing how compliance fears paralyze growth

Mosey Insight: The confidence gap reveals itself most clearly in what it costs teams: over half report burnout from managing compliance uncertainty, while nearly half scramble to find budget for compliance emergencies. Teams exhaust themselves worrying and fighting fires instead of driving strategic growth. When only 21% of leaders feel truly confident in their compliance, current approaches clearly aren’t providing the assurance organizations need to operate boldly.

4. The Financial Impact of Compliance Challenges

The financial reality of multi-state compliance hits companies from many angles, and the costs are higher than most leaders realize.

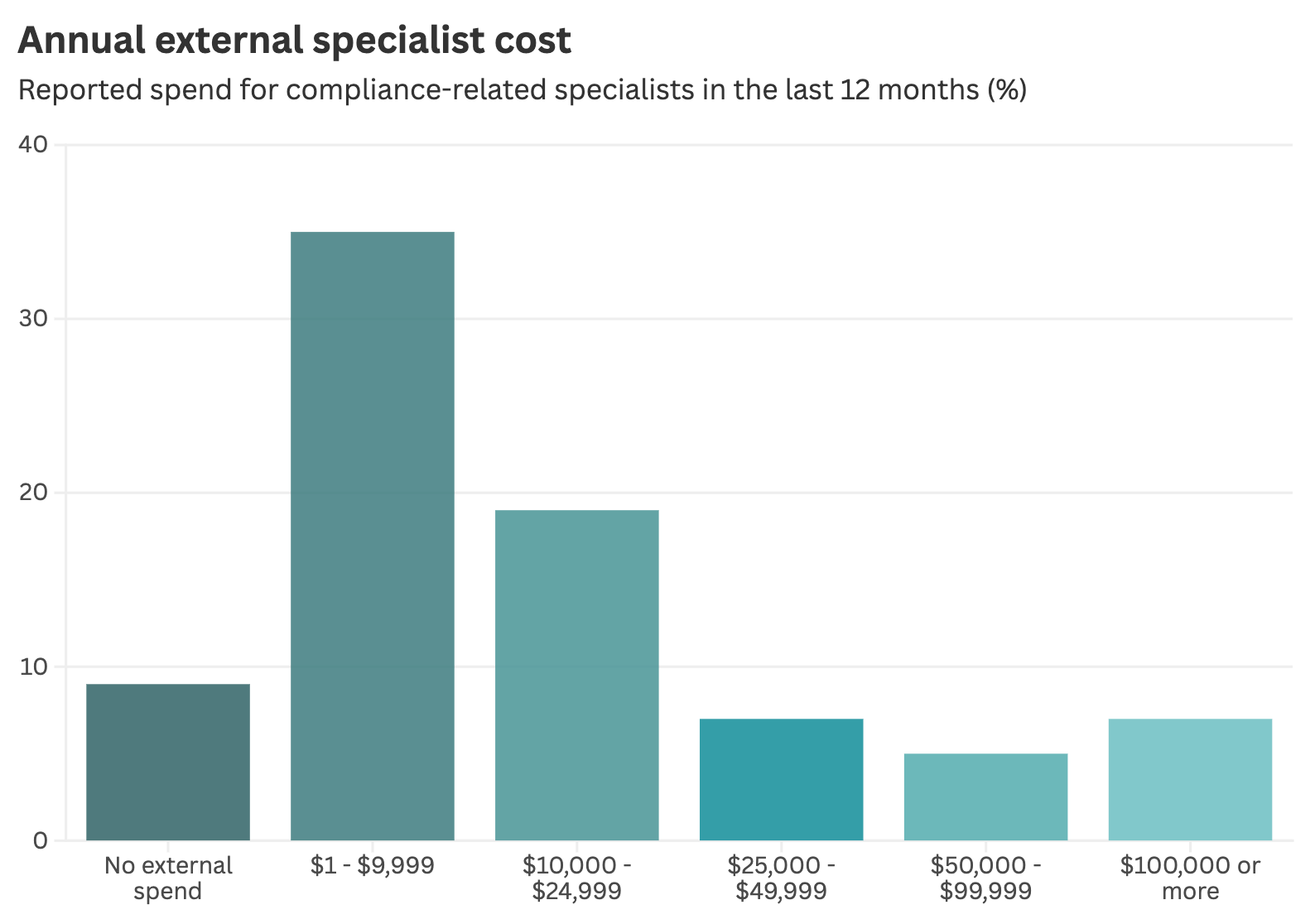

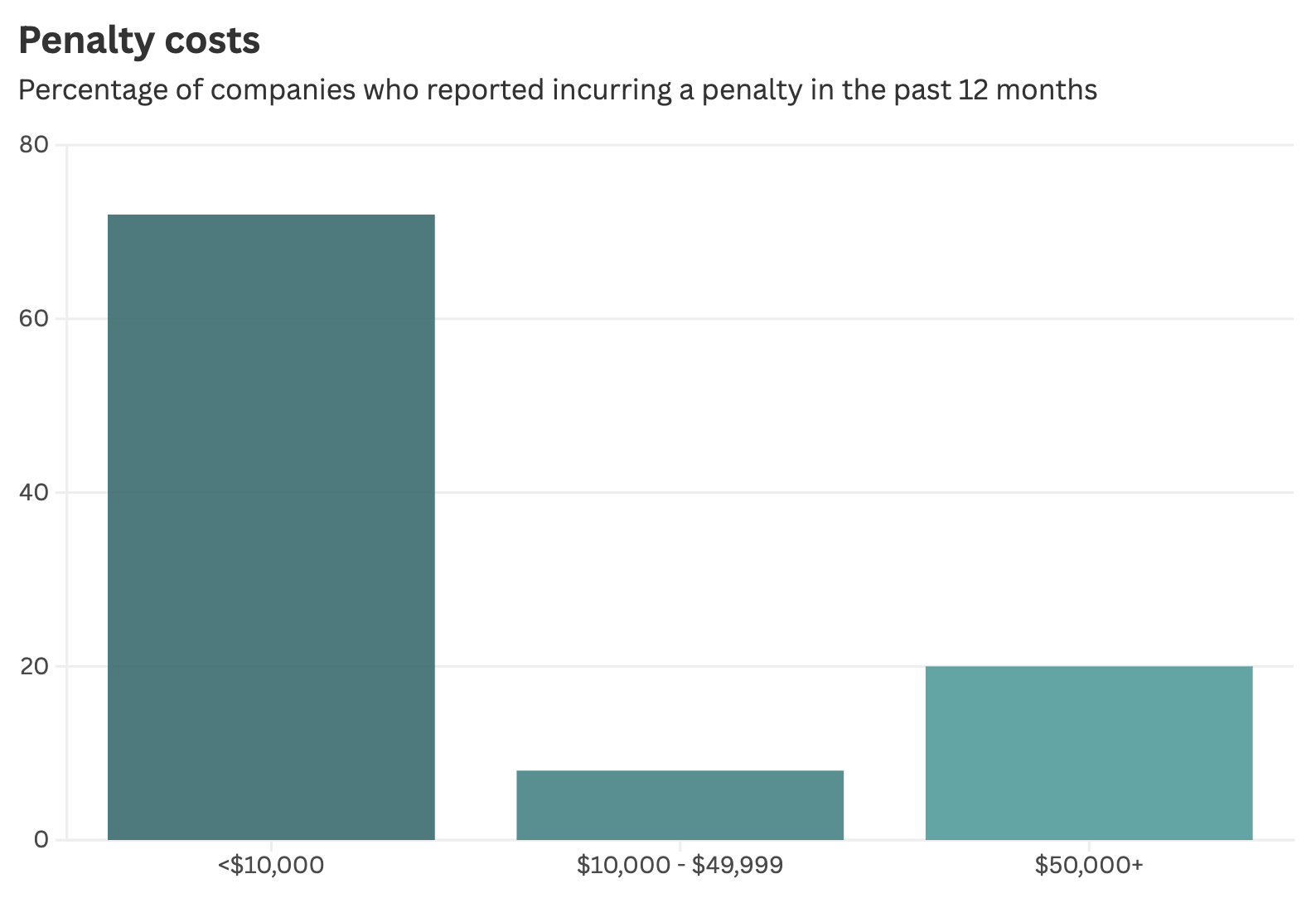

Direct Costs and Penalties

Companies are investing heavily in compliance, yet still facing costly penalties.

External Specialist Costs: Companies that use external help spend an average of $25,000 annually on consultants, legal, accounting, and tax professionals for compliance, on top of in-house spending.

Internal Time Investment: Teams dedicate an average of 28 hours per week to just managing compliance

Penalty Exposure: 33% of companies incurred compliance-related penalties, averaging $16,000 per affected company

Productivity and Opportunity Cost

But the hidden costs of compliance extend far beyond direct expenditures:

- 44% made unplanned budget allocations to address compliance emergencies

- Once again, 53% report team burnout from managing compliance, increasing missed work, turnover, and the costs involved

- 27% increased reliance on external consultants just to validate they’re compliant

Mosey Insight: The true cost of compliance goes far beyond the average external spend or even the penalties. With teams dedicating so many hours weekly to compliance tasks—mostly through manual processes and spreadsheets—organizations are sacrificing innovation and growth opportunities. Companies face an impossible choice: under-invest and risk penalties, or over-invest and drain resources. Automated compliance solutions break this cycle by providing certainty without the massive time commitment.

Download the 2025 report

Get your free copy of this year’s industry benchmark report outlining the strategic compliance insights from HR and Finance leaders.

5. Looking Ahead: What Companies Are Actually Planning

The Path Forward: 2025 and Beyond

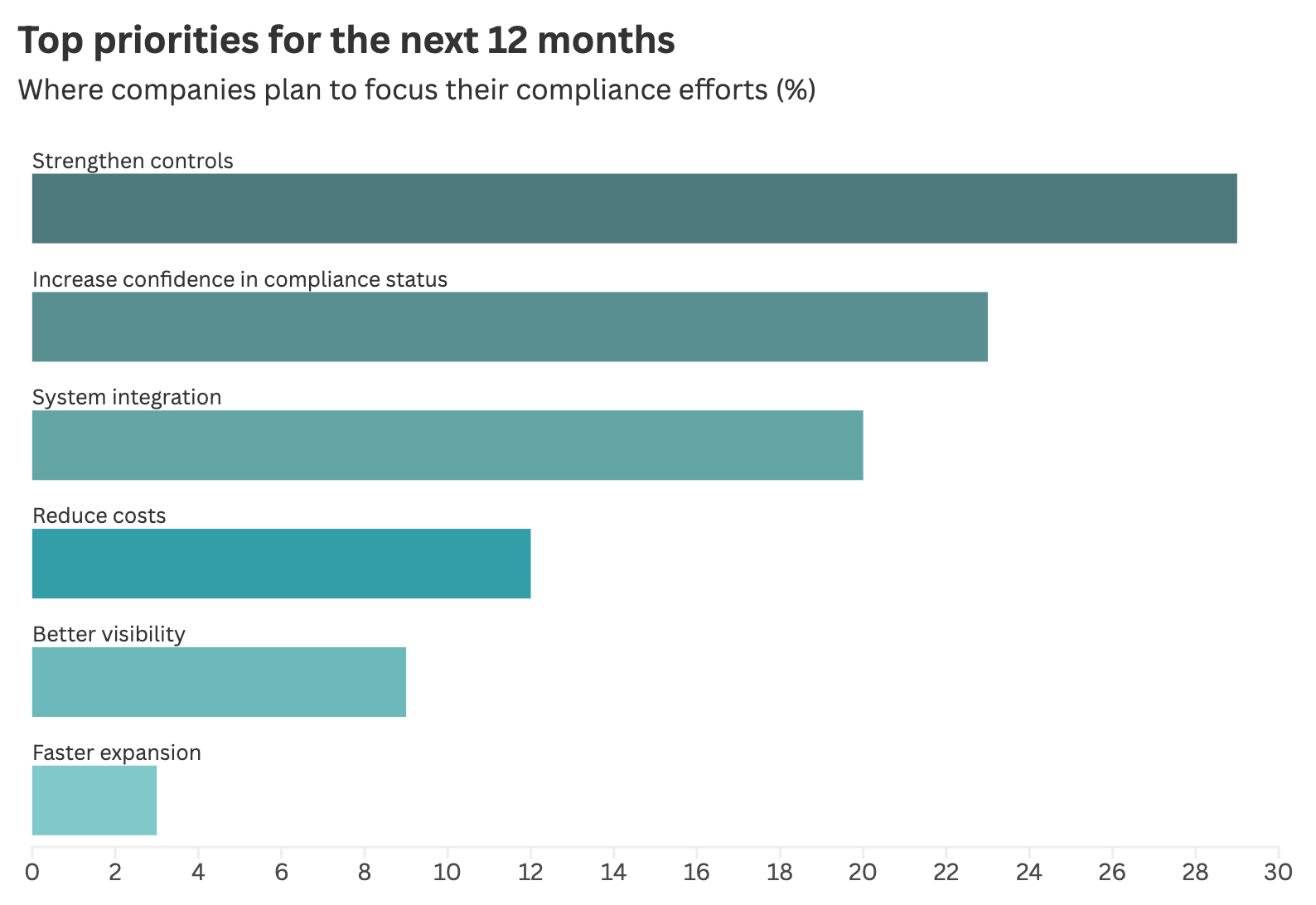

When asked about their top priorities for the next 12 months, organizations revealed a clear focus on fixing fundamental compliance challenges before pursuing growth:

52% are prioritizing control and confidence, with strengthening compliance controls and building greater confidence as the top two priorities. Given that 67% reported no penalties incurred in the last 12 months, it is less surprising that only 12% of respondents are aiming to reduce compliance costs and improve efficiency.

It is clear that growth is limited by compliance challenges at only 3% prioritizing faster expansion into new states. With 44% of businesses reporting payroll compliance, specifically new tax account registration, as a main challenge, this growth is limited by one of their most difficult processes currently.

What These Priorities Reveal

The data tells a compelling story about the state of compliance management.

Organizations are in “fix-it” mode, not growth mode. The fact that only 3% prioritize expansion—despite 73% saying they’d feel confident growing without compliance concerns—shows that companies recognize they need to solve current problems first.

Control and confidence dominate the agenda. With 52% focused on these fundamentals, it’s clear that most organizations don’t trust their current compliance approach. They value stability and certainty before anything else.

Cost reduction ranks surprisingly low (12%). This suggests the primary pain isn’t budget but rather the stress, uncertainty, and operational disruption that poor compliance creates.

Mosey Insight: The priorities data reveals that cost isn’t the barrier—effectiveness is. With only 12% focused on reducing compliance costs, companies are essentially saying “we’ll pay what it takes for something that actually works.” They want control and confidence (52% combined priority), not another tool to add to their already fragmented stack. The extremely low priority on expansion (3%) despite high growth confidence without compliance concerns (73%) proves that fixing compliance has become a mandatory precursor to growth. Companies are ready to invest in real solutions—they just need to find them. And that’s where Mosey shines.

6. How Mosey Helps

Mosey’s platform addresses these compliance challenges through a purpose-built solution designed for organizations managing multi-state operations. Here’s how our platform works:

Proactive Monitoring and Automation

Mosey makes compliance proactive through built-in automation and integrated AI assistance:

- Automated Compliance Detection: Identifies new compliance requirements based on your business activities and employee locations

- Process Automation: Guides users through each state’s unique registration process with step-by-step instructions and assistance

- Smart Notifications: Alerts the right team members about upcoming deadlines and changing requirements before they become urgent issues

Unified Compliance Dashboard

Mosey provides a single source of truth for compliance status across all 50 states for everyone on your team who need visibility:

- Mosey Dashboard: Presents your compliance status across all 50 states in a single view, with detailed tracking of entity, tax, payroll, and HR requirements

- Status Tracking: Shows at-a-glance which requirements are complete, upcoming, or at risk and whether it’s managed by us or one of our integrated platforms

- Universal Mailroom: Track physical and digital notices in one place to access, resolve, and record state and local agency communications

- Team Collaboration: Allows all stakeholders to work from the same compliance information while maintaining appropriate access controls

Built-in Compliance Knowledge

Mosey builds confidence through built-in expertise and support:

- Embedded Compliance Knowledge: State-specific, lawyer-vetted compliance requirements at your fingertips

- Expert Support: Guidance from our team of compliance specialists when facing complex challenges

- Audit-Ready Documentation: Comprehensive records for all compliance activities and statuses

Strategic Value

Beyond addressing compliance challenges, Mosey delivers strategic value to HR and finance organizations:

- Resource Optimization: Reduce time spent on compliance activities by up to 70%

- Cost Reduction: Consolidate multiple point solutions into one comprehensive platform

- Growth Enablement: Expand confidently into new states without compliance barriers

7. Transforming Compliance Management

Compliance success now hinges on a more centralized, proactive system rather than the fragmented, reactive processes of the past. The result—a seamless compliance operation that prevents issues before they occur, unlocking more opportunities for strategic business growth.

The survey’s central finding: compliance has become a significant business constraint, not just a legal challenge. Leaders who automate compliance don’t just save time—they gain the ability to scale faster, hire without hesitation, and focus on strategic initiatives instead of paperwork.

Based on these findings, the path forward for HR and Finance leaders involves:

- Automating manual processes that currently consume 28 hours weekly across teams

- Building systems that provide real control and confidence—addressing the 79% who lack high confidence in their compliance status

- Preventing team burnout that currently affects 53% of organizations managing compliance

- Eliminating unplanned budget allocations that hit 44% of companies when compliance emergencies arise

- Moving beyond spreadsheets still used by 55% of companies to purpose-built compliance solutions

Your distributed workforce isn’t going anywhere, and neither are your compliance challenges. The question isn’t whether to modernize your compliance approach—it’s whether you’ll do it proactively or be forced into it by penalties, burnout, and missed opportunities. The organizations that thrive in a multi-state environment aren’t the ones that perfect manual processes; they’re the ones that recognize compliance as a strategic function deserving of modern tools and automation. Make compliance a competitive advantage, not a constant worry.

About Mosey

Mosey is the comprehensive compliance platform for finance, payroll, and HR teams. Our solution helps companies manage entity, tax, payroll, and HR compliance across all 50 states through a single, intuitive platform.

To see what streamlined multi-state compliance looks like for your organization, request a Mosey demo today.